|

FRIDAY EDITION February 6th, 2026 |

|

Home :: Archives :: Contact |

|

Migrating to New Energy Paradigms #4Brian Bloom August 7, 2007 www.beyondneanderthal.com info@beyondneanderthal.com Migrating to New Energy Paradigms #1 -- #2 -- #3 -- #4 2008 - 2012: A critically important period Preface The benchmark against which I have been measuring the appropriateness of various alternative energies has been: "Does this particular technology offer the potential to represent a sensible replacement for oil across the planet within a decade? Alternatively: Can it replace coal within 25 years?" I am sensitive to the possibility that some readers may have been irritated by my apparently cavalier predisposition to dismiss various alternative energies which they may be favouring. In this context, let me clarify my position: I dismiss nothing out of hand. There is no insurmountable shortcoming of, for example, solar power or wind power. We should continue to embrace both. However, neither of these can (yet) generate sufficient energy to replace that generated by burning approximately 240 million equivalent barrels of oil a day; and neither will be capable of achieving this objective within either of the two deadlines. The issue is "time" as this article will demonstrate. We do not have the luxury of time. We also do not have the luxury of making any serious strategic mistakes. In my view, embracing Nuclear Fission would

be a serious strategic mistake. Although it is capable of doing the job of coal,

I have some philosophical problems with that technology partially because it will

entrench the have/have-not divide. For example, are we all going to be

comfortable for Iran Introduction The purpose of this series of articles is to validate a strategic plan which will allow us to migrate away from oil within 10 years, from coal in 25 years and, at the same time, position the World Economy for a phase of growth which will facilitate: Repayment of the debt mountainElimination of environmental pollutionEmbracement of Third World countries into the world economy - in particular in Africa, which seems likely to grow in strategic importance in the years ahead.The risks are extraordinarily high, but the rewards are glittering. This article, #4 in the series, focuses on the importance of timing. We have a window of opportunity that will begin to close if we have not developed a head of steam by 2012. *********************** Right now there are three factors which are unique to our economic environment which, in combination, might well cause an economic collapse (should it occur) to be ‘terminal'. i.e. If we do not take prophylactic action to address these environmental issues, we might well be witnessing the demise of an era in human history which has been in place since the mid 1700s, namely the Industrial Revolution. These three unique environmental factors are: It was demonstrated in article #2 that the waning of one energy paradigm has historically been anticipated by the smooth prior emergence of another replacement energy paradigm as a matter of natural course. The sequence since the commencement of the Industrial Revolution has been:

What is unique this time around is that the natural evolutionary process of energy paradigms and associated technologies has been blocked. Climate Change of the nature we are currently experiencing is unique in our lifetimes. Arguably, the last time the world experienced change of this degree was during the Little Ice Age (1300 - 1850) which is also when the Great Ocean Conveyor Belt slowed to the extent it has been slowing over the past fifteen years. Arguably, what is manifesting at this point in Earth's history may be more accurately characterised as the final "blow-off" phase of an 11,500 year cycle of Global Warming. A fall of up to 10 degrees Celsius in ambient temperature is manageable, provided we are prepared. Conversely, if we are not prepared, we can expect the World Economy to unravel. The emergence of the derivatives industry - facilitated by loose monetary policy of the US Federal Reserve - has given rise to a gambling mentality the likes of which have never before been witnessed in recorded history. Comment: One writer has estimated the total risk exposure of this industry to be upwards of $60 trillion. Objectively, if the books are balanced, this implies a $30 trillion risk on either side of the balance sheet. Also, only a proportion of this risk is ever likely to manifest as losses in the real world. Nevertheless, even assuming (say) a 5% default, this still translates to $1.5 trillion, which is around 10% of the US's annual GDP. This is also over and above the roughly $50 trillion of conventional debt that has been allowed (even encouraged) to have built up in both the private and public sectors of the USA since 1982. The problem is not technical in origin. It flows from a flaw in human nature - namely "greed". Unique to this era is the level of derivatives which may serve to magnify the pain of a debt implosion. At the extreme, if the derivatives' industry unravels, it could destroy the World Economy. On the plus side, the interference as described in 1. above (in this case by the "Greenies") has also, so far, blocked the broad embracement of Nuclear Fission, and has paved the way for new and more benign energy paradigm/s to leapfrog ahead of Nuclear Fission. i.e. If we keep our wits about us, rather than facing a potentially devastating problem, we might in fact be able to turn adversity into triumph, by fast tracking the commercialisation of an entirely new suite of energy technologies which will allow humanity to evolve to an entirely new level. The World Economy will likely also be given a significant wealth-creating shot in the arm as a consequence. The effect of this (if managed appropriately) will be to allow debt to be repaid over a period of twenty or so years even as the economy marks time. We might buy the time to regroup, and rearrange our banking systems. If we accept that there is in fact a suite of appropriate energy technologies waiting in the wings, then the "timing" of their commercialisation becomes of paramount importance. There are no fewer than four models which all point to the period 2008-2012 as being a critical period for humanity. In short, we have a window of opportunity which the models below are indicating will begin to close after 2012. Chart 1 : Chart showing when good and bad times have occurred, and will occur again (1814 - 2012) This chart has been in the writer's possession since the early 1980s. It was drawn by hand either by or for a friend (I can't remember which), and shows stock market cycles dating back to the year 1814. Looking back, it has been reasonably accurate.

Chart 2: Close up of recent cycles The model forecast the peaks and troughs of the past few cycles as follows:

Chart 3: Legend of Charts 1 & 2

Summary: This first model forecasts that 2007 is the year that investors should sell out, and that 2012 will be the year investors should buy back in again. Unfortunately, the primary issues with the above model are:

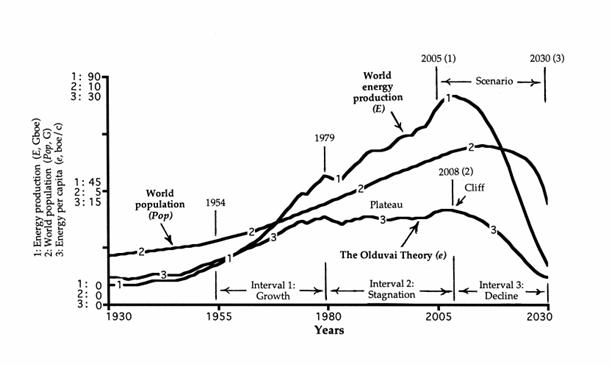

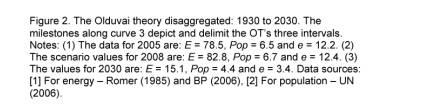

Clearly, one cannot plan one's life around such a model because biofeedback does exist and, as has been outlined earlier in this article, there are three issues which are unique to the present scenario. i.e. Everything else has not been constant. The first of these three issues is that the smooth evolution of energy models has been disturbed. The following chart (and its underlying data) demonstrates the extraordinarily high risks which flow from this. Chart 4: Pictorial Representation of the Olduvai Theory

Chart 4a: Legend

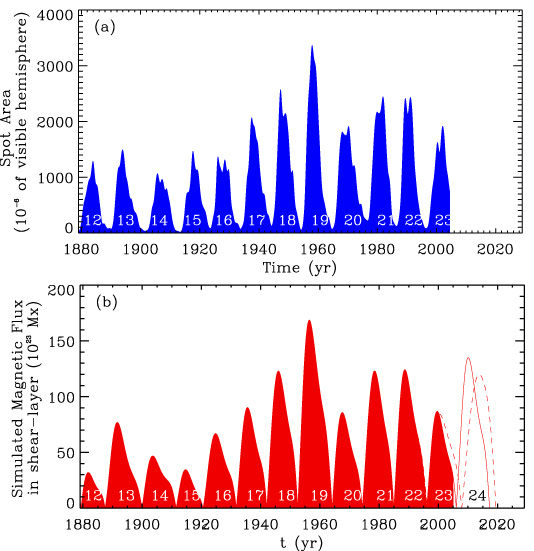

The Olduvai Theory was developed by Richard Duncan PhD about twenty years ago. Since that time he has been measuring historical world energy output and historical world population growth to derive a ratio, "energy per capita", which is reflected in line number 3 above. The above chart has been updated to include 2005 actual numbers. Energy is measured in barrels of oil or equivalent, and is derived from all sources, including coal, oil, natural gas, nuclear and hydro-electric. In summary, world energy output grew exponentially until about 1970, and then the growth rate began to slow even as world population growth rate continued unabated. The impact of this has been that energy per capita has been stagnating since around 1980 and is forecast to peak in 2007. Thereafter energy per capita is expected to begin falling. In around 2012, it is expected to collapse at the same time that world population begins to contract. Reading the above two models together, they appear to agree that 2007 will be a watershed year. However the first model forecasts 2012 as the year when markets will bottom whilst Duncan's model forecast 2012 as the year our social infrastructure begins to unravel. Either situation is reasonably possible, depending on government policy. Of course, one critically important reason why Duncan's model concludes what it does is that it assumes (implicitly) that no new energy paradigms will emerge to augment and/or replace coal, oil, natural gas, nuclear and hydro-electric. Therefore, if his twenty years of effort are going to bear fruit they will lead to the conclusion that we had better pull our finger out and get cracking! We need to stop dithering and move urgently to embrace those new energy paradigms which are both appropriate and available. I have not had personal exposure to the construction and/or workings of Richard's model. However, it is my understanding that he has factored into it a concept known as the "Attractiveness Principle". In simple English, what the Attractiveness Principle states is, as an example (my understanding, with apologies if I'm off the mark): "If you are living in Mexico (or, historically, the USSR), and the economy starts to unravel in Mexico (or the USSR), you will gravitate to a more attractive region such as the USA (or West Germany) - regardless of whether or not there is a wall between the two countries, and regardless of how well that wall is guarded. The reason is that you will be fighting for your very survival whereas the guards will be employed on salaries. The consequence of too many people migrating from unattractive countries to attractive countries is that the infrastructures in the attractive countries will be placed under enormous strain. In particular, the electricity grids will become dysfunctional, and the previously attractive countries will begin to experience brownouts and blackouts". What are the facts? The facts are that in the three months from December 2006 to March 2007, four million households across the USA experienced loss of electrical power flowing from snowstorms and blizzards. Also, there have been increasing incidences of supply interruption in the USA's oil refinery infrastructure over the past few months. By themselves, these facts are not particularly worrying. Against a background of a possible trend that we were already expecting to emerge, we will ignore these developments at our peril. Strategic Planning is all about "being where the puck is going to be". All this begs the question: Why 2012? What's so special about that particular date? This brings us to the second unique factor lurking in the background, namely Climate Change. It may be nothing other than a coincidence, but the following might be of significant interest to those whose minds are still open on the subject of Climate Change: "Habibullo Abdusamatov, head of the space research laboratory at the St. Petersburg-based Pulkovo Observatory, said global warming stems from an increase in the sun's activity. His view contradicts the international scientific consensus that climate change is attributable to the emission of greenhouse gases generated by industrial activities, such as the burning of fossil fuels and deforestation. "Global warming results not from the emission of greenhouse gases into the atmosphere, but from an unusually high level of solar radiation and a lengthy - almost throughout the last century - growth in its intensity," Abdusamatov told RIA Novosti in an interview"... "Instead of professed global warming, the Earth will be facing a slow decrease in temperatures in 2012-2015. The gradually falling amounts of solar energy, expected to reach their bottom level by 2040, will inevitably lead to a deep freeze around 2055-2060," he said, adding that this period of global freeze will last some 50 years, after which the temperatures will go up again". Source: http://en.rian.ru/russia/20070115/59078992.html So, although Duncan's model and Abdusamatov's model are both targeting 2012 as the watershed year, Duncan's "driver" is the Attractiveness Principle, and Abdusamatov's driver is Sunspot Activity. Is the 2012 intersection of these two models a coincidence? Perhaps, but now we have two coincidences. Let's not forget the first model, flawed as it may be. Frankly, I have nothing but instinct to go on at this stage, but my hypothesis is that Duncan' Model and Abdusamatov's model are somehow linked, and the linkage might be found by examining more closely the biological pulsation of the energy markets (as demonstrated by Cesare Marchetti and referred to in a pervious article) and the pulsation of the sun's intensity as identified by Abdusamatov and, possibly by implication, by Milutin Milankovitch before him. In fact Milankovitch spoke about the inclination of the Earth's orbit which has a 100,000 year cycle relative to the invariable plane, but he did not address what might cause this inclination). What does cause the sun to pulsate, and why, in particular, has the level and intensity of its pulsation been rising in recent years? To jog the reader's memory, the following chart of sunspot activity to which I referred in an earlier article is reproduced below (The blue above is actual, whilst the red below is the model): Chart 5

Source: http://www.ucar.edu/news/releases/2006/sunspot.shtml Since 1938, the average intensity of sunspot activity has been above that which prevailed before that time as far back as 1880, and the model is anticipating cycle #24 to be unusually active, peaking in around 2012. So, to repeat: Why has the level and intensity of the sun's pulsation been rising? One answer may lie in the following chart, which shows a computer generated graphic model of the position of our sun in the heavens as it is forecast to be on December 21st 2012. Chart 6

Source: Mayan Calendar (John Major Jenkins) On that particular date the ecliptic (path) of our sun is expected to intersect the equator of the Milky Way Galaxy, through which it travels in its own orbit. i.e. The sun will reach the epicentre of our galaxy. This begs the question: Could this culmination point of our sun's cyclical journey, preparatory to the commencement of its next cycle, be the ultimate driver of the 100,000 year Milankovitch Glaciation cycle? Frankly, I don't think it will be productive to go down that particular rat hole in this article. Suffice it to say that we now have four apparently unrelated models which all point precisely to the year 2012. When all is said and done at least one credible person, Habibullo Abdusamatov , is convinced that the pulse activity of our sun will begin to wane after 2012, and that the temperature of our planet will begin to cool thereafter. If he is correct, then the need to replace fossil fuels with more powerful energy paradigms will become more urgent because the following issues will need to be addressed: Overhead power grids will be negatively impacted by more intense winter weather and will likely become more vulnerable - i.e. Richard Duncan's Olduvai model (which anticipates increasing brown-outs and blackouts) may turn out to be correct, exaggerated by weather related developments. The need for artificial heating will be heightened, which will place a strain on existing power generation capacities. Increased demand for coal will place increased strain on transport facilities, exaggerating our dependence on waning supplies of oil.Farm yields per hectare will decrease in cooler weather, and farming activity in different geographic regions more remote from the world's markets may need to be stimulated - in particular regions closer to the equator and in Southern Hemisphere regions. (Third World countries will need to become more agriculturally productive so that Northern Hemisphere societies might survive. Yes, we are all in the same boat. Aren't we glad we looked after the people who live in these regions when times were tough for them?)Under circumstances such as these, transport logistics will become more complex.As an aside, the Nuclear Fission Industry is lobbying for $50 billion government loan guarantees to build 28 new plants across the USA. How are they going to deliver the electricity? By these very same vulnerable overhead wire grids which seem likely to become increasingly dysfunctional as Global Cooling unfolds. Remember: "Strategic Planning is all about being where the puck is going to be". Let's not get ahead of ourselves. Nuclear Fission is not a panacea. Arguably, all of the above is highly theoretical. So, coming back down to earth, is there anything in the real world which might validate the importance of the convergence of these four disparate theoretical models in the year 2012? The short answer is "yes". The chart below (courtesy decisionpoint.com) is up to date to July 30th 2007. It is a monthly chart of the Dow Jones Industrial Index dating back to 1920 Chart 7

The upper boundary trendline has been drawn in by joining the 1929 top to the 1999/2000 top. The lower trendline is more complex. Readers will note that it was travelling almost parallel to the upper trendline until about 1982, at which point it went exponential. That was the year that the Reagan Administration decided to use the US Consumer as the "driver" of the World Economy and to deliberately engineer a situation where the USA operated as a sovereign debtor nation. Since then, the USA has become the world's largest debtor nation. That was also the year that the Federal Reserve started to deliberately engineer a fall in interest rates, as can be seen from the following chart of the 30 year bond yield. Chart 8

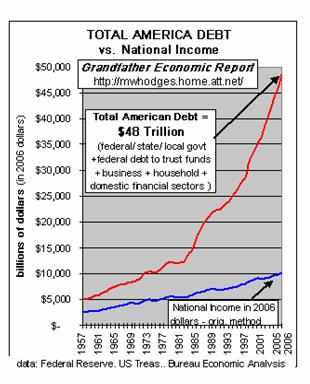

The reader is asked to look closely at chart 7, and the date of the intersection of the two red trendlines. They intersect in 2012! This is the fourth "coincidence". How many coincidences do we need before we start to pay attention? Since 1982, the Dow Jones has risen roughly fourteen fold, or by roughly 11% p.a. This growth has not come about as a result of wealth building activities in the USA so much as loose monetary policies of the US Federal Reserve. (By definition, "service industries" such as IT are there to service the economy. They cannot "drive" the economy). 1982 was also the year when the US Debt levels started to explode, as can be seen from the following chart Chart 9 (Source: http://mwhodges.home.att.net/summary.htm )

Summary and Conclusions In article #2 of this series, it was demonstrated that the world's markets for internal combustion powered motor cars was trending towards saturation in the West in 1975-1980. Rather than allow the smooth emergence of the next energy paradigm, which would have served to drive the world economy with a new set of associated technologies, the Reagan Administration moved to artificially stimulate the world economy by orchestrating a loose monetary policy, This loose monetary policy, augmented by downward pressure on interest rates, has led to over $48 trillion of US Debt, plus a $60 trillion risk exposure in the World's Derivative Industry. The Central Banks have, literally, stuffed the World Economy. We now have a situation where four theoretical models are all pointing to 2012 as the year by which, if remedial action has not been taken, we might expect the entire house of cards to come tumbling down. This 2012 target is further validated by the 80 year chart of the Dow Jones Industrial Index, given that the two trendlines intersect at exactly the same point as is being anticipated by the three models. There are three possible outcomes: If the Members of the United States Federal Reserve Board persist in their ill advised strategy of pumping cash into the system as a substitute for wealth building activities, the chart will break up above the top trendline, and the world economy will likely enter a period of asset hyperinflationIf the Governments of the world continue to support the Fossil Fuel Industries, but the US Fed recognises the folly of its monetary strategy and tightens the money supply, we are likely to experience a break down below the lower trendline. Under these circumstances, the debt mountain is likely to implode, and the derivative mountain along with it.If the Governments of the world move rapidly to migrate the world economy from its dependence on fossil fuels to appropriate new energy paradigms, then it may be possible to trade out of the problems by causing the world's markets to enter a long term (20 years +) trading range. During this period, the new energy paradigms can give the world economy a shot in the arm, and true wealth (as opposed to money) can be created. Some of this wealth can be diverted to repay outstanding debt.To be thorough in our analysis, there is a fourth possibility - which is that the Governments of the world might move rapidly to embrace inappropriate new energy paradigms. That will not solve any problems. The walls behind the wallpaper will still have cracks. Caveat 3. above is "not negotiable". If it is not implemented, and the economy enters either a Primary Bear market or a hyperinflationary blow-off phase at roughly the same time that the planet enters a Cooling Period, then the demands on our electricity grids will become unsatisfiable - whether or not the 28 new Nuclear Plants being planned are built, or whether or not the 54 new coal fired plants being planned are built - and the Olduvai Theory will prove to be correct. The situation will become irretrievable. Fortunately, appropriate alternative energy paradigms are available. They are clearly outlined in my novel, Beyond Neanderthal, which is currently being edited for publication. Please register your interest to acquire a copy by going to http://www.beyondneanderthal.com/sample-chapter.html This series will have two more articles: US Fed Policies have been geared to facilitate the making of money by some people and, in the process, these processes have unwitting given rise to destruction of wealth across society as a whole. The rich have gotten richer, but the poor have gotten disproportionately poorer. The next article will explain the difference between making money and creating wealth. The final article will set out a step by step plan of action to migrate away from Fossil Fuels towards appropriate new energy paradigms. It will contain broad brush milestones and broad brush cost estimates. The amount of Government support required will be "petty cash" relative to what the Nuclear and Coal industries are lobbying for. Brian BloomAugust 7, 2007 www.beyondneanderthal.com info@beyondneanderthal.com Since 1987, when Brian Bloom became involved in the Venture Capital Industry, he has been constantly on the lookout for alternative energy technologies to replace fossil fuels. He has recently completed the manuscript of a novel entitled Beyond Neanderthal which he is targeting to publish within six to nine months. The novel has been drafted on three levels: As a vehicle for communication it tells the light hearted, romantic story of four heroes in search of alternative energy technologies which can fully replace Neanderthal Fire. On that level, its storyline and language have been crafted to be understood and enjoyed by everyone with a high school education. The second level of the novel explores the intricacies of the processes involved and stimulates thinking about their development. None of the three new energy technologies which it introduces is yet on commercial radar. Gold, the element, (Au) will power one of them. On the third level, it examines why these technologies have not yet been commercialised. The answer: We've got our priorities wrong. Beyond Neanderthal also provides a roughly quantified strategic plan to commercialise at least two of these technologies within a decade - across the planet. In context of our incorrect priorities, this cannot be achieved by Private Enterprise. Tragically, Governments will not act unless there is pressure from voters. It is therefore necessary to generate a juggernaut tidal wave of that pressure. The cost will be 'peppercorn' relative to what is being currently considered by some Governments. Together, these three technologies have the power to lift humanity to a new level of evolution. Within a decade, Carbon emissions will plummet but, as you will discover, they are an irrelevancy. Please register your interest to acquire a copy of this novel at www.beyondneanderthal.com . Please also inform all your friends and associates. The more people who read the novel, the greater will be the pressure for Governments to act. |

| Home :: Archives :: Contact |

FRIDAY EDITION February 6th, 2026 © 2026 321energy.com |

|