|

TUESDAY EDITION February 24th, 2026 |

|

Home :: Archives :: Contact |

|

Get Ready for the Next Oil Price SurgeJay Taylor

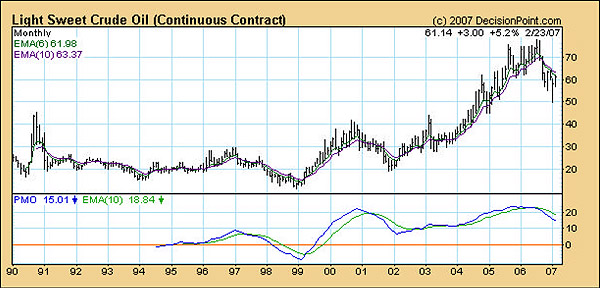

I recently read a report on “Peak Oil” by a British professional investor named Jim Brown. This is an 86-page report available at http://www.100dollaroil.com/. Having read this report, I find it to be a well-researched position that is presented in a highly logical manner. Data used in the report is reportedly from large oil company reports to their shareholders. Mr. Brown also publishes a weekly report on investments at www.optioninvestor.com, in the LEAPs section. “The world remains blissfully ignorant of the approaching end of cheap oil. The world currently uses more than 31 billion barrels of oil per year. Over the past 15 years we have averaged discoveries of only 9 billion barrels of oil per year. We are replacing only 1 of every 3 barrels of oil we consume and the discovery rates are falling. All the major oil companies have already admitted they can no longer replace the reserves they are draining every year. They are not even raising their capital expenditures budgets because they know it is futile to continue punching dry holes. The American public refuses to wake up to this harsh reality and it will be a nightmare on Wall Street when the peak in oil production arrives sometime before 2011. “Those still exploring are racing forward at a frantic pace to locate the last remaining pockets of oil left on the planet. WE know where those deposits are. Geologists have known since the 1950s exactly what geological conditions must exist to produce oil. Those conditions exist on less than 1% of the planet’s surface in a little over 4,000 locations. The easiest of those 4,000+ deposits have already been drilled and are giving up their lifeblood of oil at a record pace. Those remaining to be drilled exist in places like the Arctic, in very deep water over 7,500 ft., in hostile countries, in unconventional plays like oil shale and in locations too small to be commercially viable even at $60 a barrel. The low-hanging fruit has already been picked, but the energy consumer refuses to back away from the banquet table.” Those are the words of Jim Brown, a U.K. professional investor who makes his report available free of charge at www.powerswitch.org. This is an in-depth account of the state of affairs in the oil industry today, and he makes a very strong case that we will be looking at oil north of $100 in 2007–2008 and $150 by 2011. But what about the recent decline in the price of oil to under $60? Isn’t that evidence the bull market in oil is over? Hardly, according to Brown. All we have had is a temporary excess inventory of oil on the world markets caused by the following three factors:

What Will $100 to $150 Oil Mean for America? If he is right and peak oil actually begins to hit us hard along about 2010 and 2011, then we can expect some major changes in the way Americans live their lives. However, those who are perceptive enough to see these changes coming will be able to profit by putting their money into assets that will continue to increase in value. Brown argues that, “energy investments will become the only game in town as regular stocks and real estate crumble.” While I think regular stocks and real estate may well “crumble,” I remain hugely bullish on gold and gold stocks. And, as long as rising energy prices are monetized by the Federal Reserve Bank, I am even more bullish on silver and silver mining stocks. Though Brown doesn’t include gold and silver as other options for gaining wealth, I simply chalk that up to “mainstream ignorance” with respect to money. Actually, because of his mainstream ignorance of gold and silver as money, I think his target price of $150 oil may be very greatly understated. If as promised, Ben Bernanke continues to print money and accelerate that practice like the Germans did on their way to hyperinflation to simply avoid the next depression, in theory, there are no numerical limits to which the price of oil could climb by 2010 or 2011 when peak oil occurs. It’s all a matter of confidence in the dollar, which is why we insist you buy not only energy stocks (with an emphasis on north American uranium plays) but that you also buy gold and silver and gold and silver mining stocks. Keeping a peak oil date of 2010 or 2011 in mind, I would also remind you that 2010 or thereabouts was the date set by economist Walter “John” Williams for a possible hyperinflationary depression. But getting back to Brown’s report, here are some of the major economic consequences he sees resulting from the impending oil crisis. “Workers will flee the suburbs to cram themselves into the inner cities to avoid the increasingly expensive commute. The auto industry will implode when they can no longer produce monster SUVs with big profits stickers. Energy efficient vehicles have smaller price tags and even slimmer profit margins. Currently the top 10 most efficient cars in the US account for only 2% of sales. Eventually, SUVs will account for 2%. Airlines will be forced to cut back and consolidate once again as fuel prices double and triple. Airline travel will be reserved for only the privileged few and for those absolutely necessary business trips. The movie consumer will become increasingly less traveled. Vacations and holiday trips will be reduced considerably and the travel/hotel industry will evaporate. “Prices of everything moved by truck will rise sharply. Prices for everything produced from/by/with oil will spike. Ninety-eight percent of the world’s food supply is produced with fertilizer made from oil and gas products. Ninety-five percent of global transportation is fueled by oil. People will have to decide if they want to eat or travel, because both will not be possible at the current scale. Those with the most bearish outlook suggest the world population could drop by 3 billion before 2050, simply because there will not be enough food or it will not be cost effective to ship it around the world. When fertilizer supplies fall sharply, the quality and quantity of crops will shrink. Exports will no longer be profitable and countries will have to keep all their crops just to feed their own population. Those countries that depend on imports of food will be forced to either starve or pay exceedingly high prices for available supplies, effectively shutting out those poorer countries that cannot afford the bill.” I don’t mean to be a doom-and-gloom guy, but when you can see the handwriting on the wall, it would be irresponsible and tragic to ignore it in order to be politically correct. I would encourage you to read Brown’s report, which is chock-full of fundamental supply-and-demand analysis, and then continue to plan your investment strategy accordingly. This past week, I finally had an opportunity to read the 2007 Annual Forecast by Stratfor; I must admit Ian could well be correct in predicting China could trigger a deflationary implosion of the global economy. For those of you who may not be aware of Stratfor, it is a firm that specializes in providing intelligence in the areas of geopolitics, security, and public policy that is helpful to investors in an increasingly global marketplace. I have been impressed with the quality of information, the accuracy of which is collaborated from various other sources. I would suggest if you are interested in geopolitics, this is one source you should subscribe to. You can learn more about this excellent service by visiting www.stratfor.com. Their problem is internal, with a huge overhanging portfolio of nonperforming and troubled loans. A conservative estimate is that bad loans in China equal about 40 percent of gross domestic product. A more reasonable estimate is about 60 percent. These numbers closely resemble those of Japan in 1990 and tower over those of South Korea or Taiwan in 1996. The Chinese have huge currency reserves—but then so did Japan, South Korea and Taiwan. Those reserves historically have not stabilized Asian banking systems when the consequences of undisciplined lending come home to roost. Chinese enterprises have used exports—as did Japan and South Korea and Taiwan—to mention cash flow to pay loans. But surging profitless exports merely exacerbates the problem. The Chinese government tried to stop the runaway train in 2006; it failed to do so. Westerners have again confused high growth rates with economic health, as they did with Japan and East Asia. But where rates of return on capital are extremely low or even negative, high growth rates are a symptom of disease. (emphasis mine) Could a Chinese Depression Change this Bullish Picture for Energy? Our IDW keeps making new highs, which means that our broadly defined measure of inflation keeps on rising to new highs. And since our investment strategy is linked to our IDW, so too has our Model Portfolio continued to rise very considerably. When I last spoke to Ian and told him how my IDW is requiring that we position our investments to profit from inflation rather than deflation, he suggested that China might well hold the key to a reversal of our IDW. This past week, I finally had an opportunity to read the 2007 Annual Forecast by Stratfor; I must admit Ian could well be correct in predicting China could trigger a deflationary implosion of the global economy. For those of you who may not be aware of Stratfor, it is a firm that specializes in providing intelligence in the areas of geopolitics, security, and public policy that is helpful to investors in an increasingly global marketplace. I have been impressed with the quality of information, the accuracy of which is collaborated from various other sources. I would suggest if you are interested in geopolitics, this is one source you should subscribe to. You can learn more about this excellent service by visiting www.stratfor.com. In its Annual Forecast, Stratfor said the following about China on pages 3 and 4: “The Chinese are looking inward primarily. Their problem is internal, with a huge overhanging portfolio of nonperforming and troubled loans. A conservative estimate is that bad loans in China equal about 40 percent of gross domestic product. A more reasonable estimate is about 60 percent. These numbers closely resemble those of Japan in 1990 and tower over those of South Korea or Taiwan in 1996. The Chinese have huge currency reserves—but then so did Japan, South Korea and Taiwan. Those reserves historically have not stabilized Asian banking systems when the consequences of undisciplined lending come home to roost. Chinese enterprises have used exports—as did Japan and South Korea and Taiwan—to mention cash flow to pay loans. But surging profitless exports merely exacerbates the problem. The Chinese government tried to stop the runaway train in 2006; it failed to do so. Westerners have again confused high growth rates with economic health, as they did with Japan and East Asia. But where rates of return on capital are extremely low or even negative, high growth rates are a symptom of disease. (emphasis mine) “China’s financial system already has changed dramatically from the way it was a few years ago. Internal lending and financing patterns have shifted, and foreign direct investment—excluding money being recycled by the Chinese—has declined substantially. Many deals that were launched with high expectations five years ago are facing substantial problems or failure. But the most important changes in China can be seen in its politics. The Communist party chief in Shanghai and hundreds of his allies have been arrested for corruption. Incidents of resistance to land seizures have increased, bringing with them violence and arrests. The Party has reasserted itself as the master of the state, and the Chinese security services have increased their intrusiveness and vigilance. In China, putting off the reckoning as long as possible and controlling the social and political consequences as efficiently as possible are the orders of the day. Beijing is trying to regain control of the economy—but it is more likely to do so through political power than through economic processes. “For Westerners, the question on China is, when will it crash? For the Chinese, the question is, how do you save the Party apparatus in the face of enormous economic and social stress? It should be recalled that Japan did not just fall apart one day. It experienced an enormous growth surge, followed by a managed decline of growth in which the pain was distributed economically. For China, the problem is the failure to slow growth. This failure has told the leadership that they need to increase the power of the state, and of the Party over the state. In a hundred ways, that is happening.” Speaking in more detail to the problems facing China, Stratfor said the following: “We are consistently asked when this economic crisis will strike China. But that is the wrong question. It is not a matter of when financial troubles will strike; they already have. It is a matter of how they manifest, how the Chinese deal with them and whether the Chinese are capable of controlling the situation. “If China already is in the grips of an economic crisis, why is no one noticing? In part, it is because the problems are manifesting primarily in social and political reactions, not in raw economic numbers. In part, it is because China’s sheer size makes it difficult to fathom economic collapse. And in part, it is because investors and observers have consistently been behind the curve on noticing negative trends in Asian economies. Look at Japan. “The Japanese economic malaise struck in the late 1980s with little fanfare, and most investors and observers did not even notice there was a problem until several years later. Early indicators, including the massive rush of Japanese capital abroad, were ignored or seen as signs of strength. But Japan went from being the net rival of the United States to being the moribund economic sluggard of East Asia. China can only hope to have such a controlled slowdown. (emphasis mine) “In our annual forecast for 2006, we said that signs of instability in the Chinese economy would manifest themselves—and they did. International ratings agencies issued reports citing massive inefficiencies and bad debts in the banking system. Foreign direct investment (FDI) into China stagnated for the third year in a row in 2006. A closer look at the FDI number, however, reveals that while the total dollar amount has remained relatively steady since 2004, the percent of FDI coming from Hong Kong and the free ports, such as the Virgin Islands, has increased. That means FDI from the United States and Asia is dropping. Though it is not making headlines, an unseen hand is at work. The shine is rubbing off China, and money is slowing down. “The slowdown in new funds is affecting Beijing’s ability to move money around within the country. China’s economic growth has been anything but even, and the regional wealth gaps, as well as the urban-rural split, are rising significantly. These are now the focus of government officials on all levels—and a frequent topic of discussion in the Chinese state media. An abundance of individuals, state think tanks, research institutes and government surveys are highlighting the problem, but there is a dearth of concrete solutions. (emphasis mine) “The Chinese government has been nothing if not masterful in delaying and diffusing the impact of its economic troubles. It has used tactics ranging from a massive shell game with bad debt in the banking system (passing off the problems to the asset management companies and inviting foreign banks to buy stakes in order to flesh out the equity-to-debt ratio in the major banks) to misdirection of public attention (to China’s space program, the Olympic preparations and disagreements with Japan over interpretations of history). “As Beijing selectively treats the symptoms of years of inefficient “Asian-style” economic planning, it is hoping to postpone the pain indefinitely. Beijing wants neither the Japanese-style economic malaise nor the sudden crash seen in East Asia in 1997. The central government has thus far been unable to coerce or entice local and provincial leaders to accept the economic reforms, so Beijing is turning to a tried-and-true method: sacking officials. The September 2006 move against the leadership in Shanghai was just a warning shot. Chinese President Hu Jintao is reshuffling the deck at the local and provincial levels ahead of an overhaul of the top leadership at the Party Congress later in the year. “This year likely will bring a new vice president, along with several replacements on the Central Committee and Politburo. Though age will be the given reason for the replacements, the underlying issue is the centrality of not only the Party, but also Hu’s leadership. He is cleaning house, removing the remnants of the Jiang Zemin regime and any opposition to his ‘new left’ movement. “Hu plans major changes in the economy, not the least of which is recentralization. These changes will not come all at once, and will be unlikely until after the 2008 Olympics. But the groundwork is being laid now. “Social and political opposition will be repressed in the name of stability and strength. But this will really come in late 2008 or early 2009. “For now, Hu simply needs to lock in his control and ensure that the leadership from the top down owes its loyalty to him and not to foreign business interests. He is doing this through purges, new guidelines for choosing local and provincial leaders and scheduled changes in the top echelons.” (emphasis mine) Jay Taylor This is Jay Taylor speaking for Taylor Hard Money Advisors (“THMA”), publisher of J Taylor’s Gold & Technology Stocks newsletter as of December 25, 2006. Our weekly telephone Hotline messages are normally updated every Saturday at 8:00 p.m. ET unless otherwise notified. As always, all monetary quotes mentioned in this Hotline message are in U.S. dollars unless otherwise noted. The opinions expressed in this message are those of Jay Taylor only and they do not necessarily represent the opinions of Taylor Hard Money Advisors, Inc., the publisher of J Taylor’s Gold & Technology Stocks. The management of THMA may, from time to time, buy and sell shares of the companies recommended in J Taylor’s Gold & Technology Stocks newsletter and in this Hotline message. No statement or expression of any opinion contained either in this Hotline or in J Taylor’s Gold & Technology Stocks newsletter constitutes an offer to buy or sell the securities mentioned herein. J Taylor’s Gold & Technology Stocks, is published monthly as a copyright publication of Taylor Hard Money Advisors, Inc. (THMA), Box 770871, Woodside, N.Y. Tel.: (718) 457-1426. Website: www.miningstocks.com. THMA provides investment advice solely on a paid subscription basis. Companies are selected for presentation in this publication strictly on the merits of the company. No fee is charged to the company for inclusion. The currency used in this publication is the U.S. dollar unless otherwise noted. The material contained herein is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information contained herein is based on sources, which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Any opinions expressed are subject to change without notice. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein. All such positions are denoted by an asterisk next to the name of the security in the chart above. No statement or expression of any opinions contained in this publication constitutes an offer to buy or sell the securities mentioned herein. Under copyright law, and upon request companies mentioned herein, from time to time pay THMA a fee of $250 per page for the right to reprint articles that are otherwise restricted for the benefit of paid subscribers. Subscription rates: One Year $159; Two Years - $264; Three Years $360. Foreign delivery postal system, add 25% to regular prices. |

| Home :: Archives :: Contact |

TUESDAY EDITION February 24th, 2026 © 2026 321energy.com |

|