|

THURSDAY EDITION January 8th, 2026 |

|

Home :: Archives :: Contact |

|

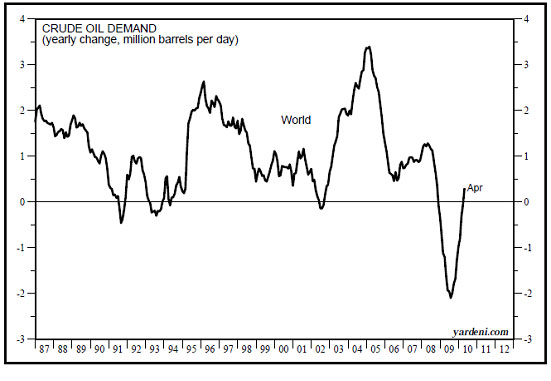

Crude Realities?Puru SaxenaJune 20th, 2010 www.purusaxena.com puru@purusaxena.com Without a doubt, the oil spill in the Gulf of Mexico is an environmental disaster. Unfortunately, as far as the global economy is concerned, Mr. Obama's six-month moratorium on new offshore drilling is an even bigger disaster. Remember, the supply of crude oil is already struggling and in order to offset the ongoing depletion, the world desperately needs to find new oil-fields. Thus, by stopping new exploratory drilling in the Gulf of Mexico, the US establishment is wasting precious time. Look. Crude oil is the lifeblood of the global economy and it is notable that over the past decade, most of the new oil-fields have been discovered offshore. Today, an increasingly large proportion of crude oil is produced from offshore fields, so banning new exploration in the Gulf of Mexico is a bad idea. In a recent interview, the International Energy Agency's (IEA) Executive Director - Mr. Nobua Tanaka opined, "The future potential for oil supply is offshore in deeper water and in the Arctic, so if offshore investment is going to be slowed down, that is a concern." He added, "We have to learn from the accident and we need a good supply from offshore in the future." For the first time ever, we are in total agreement with the IEA. After years of research, we know that ultra-deep offshore oil is our only hope to combat 'Peak Oil'. Yes, the Deepwater Horizon incident is an environmental tragedy but we should be realistic here. Given the unbelievable complexities of offshore oil exploration and production, the occasional accident is bound to happen. So, instead of punishing the energy industry, we should in fact remain grateful that such accidents do not happen more frequently. The truth is that the energy industry produces 86 million barrels of oil per day and it does so from extremely complex oil-fields. Therefore, rather than pointing our fingers towards the energy companies, we should all be thankful that such disasters are rare and isolated events. In any event, the recently announced moratorium on new offshore drilling will further reduce the supply of crude oil. More importantly, if Mr. Obama's administration gets very tough with BP, then the other oil companies may think twice before attempting to tackle technologically-challenging projects. After all, if the risk of political backlash was high, why would any oil company take on a complex project in a new frontier? So, whichever way you look at it, the recent developments in the US are likely to depress future oil-production. It is worth noting that in its 'World Energy Outlook 2009' report, the IEA confirmed that in order to meet energy demand in 2030, the world needs to invest a staggering US$26 trillion over the next 21 years! Well, given the reluctance of banks to lend, the suspension of exploratory offshore drilling in the Gulf of Mexico and the growing political angst, it is clear that capital spending will fall short of the required amount. Undoubtedly, this lack of adequate investment will further dampen future supplies. As far as global oil usage is concerned, it is noteworthy that demand is on the rise again. Figure 1 shows that over the past twelve months, worldwide consumption of oil increased by roughly 500,000 barrels per day. This is an impressive feat when you consider that oil consumption in the developed world is still under pressure. Figure 1: Global oil-demand is rising

Source: Ed Yardeni Whether you like it or not, oil demand is surging in the developing world and this trend is likely to remain intact. Despite the economic problems in much of the developed world, the developing nations are burning more and more oil for the following reasons:

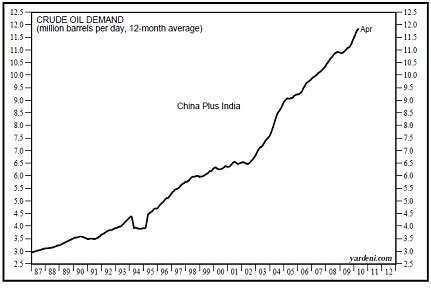

If you are still sceptical and have any doubts, Figure 2 should put them to rest. As you can see, the combined oil-consumption in China and India is at a record-high. Today, these nations' combined oil-consumption comes in at roughly 12 million barrels per day (14% of global usage) and what is really astonishing is the fact that demand has doubled over the past decade! Finally, it is worth noting that over 2.3 billion people reside in these two Asian nations and most of them still do not own automobiles. So, as these people climb up the prosperity ladder, demand for energy in these two countries will continue to appreciate. Figure 2: A third of the world is thirsty for oil  Source: Ed Yardeni Bearing in mind these facts, one can safely state that demand for oil will continue to rise in China, India and other parts of the developing world. More importantly, given the sheer number of people in Asia, Latin America and the Middle-East, the demand growth from these developing countries will most probably offset the declining demand for oil in the developed world. In summary, apart from short-term setbacks during recessions, global demand for oil will continue to rise. On the other side of the ledger, the ongoing depletion, lack of new discoveries and cutbacks in capital spending will put a firm lid on oil supply. Last but not least, when you take into account the ongoing debasement of paper money, it becomes obvious that the price of crude is set to rise, perhaps remorselessly. After considering all the data, we maintain our view that as long as the global economy is in an expansionary mode, the price of oil will surprise to the upside and top-quality energy companies will announce outstanding operating results. Accordingly, every investor should consider allocating some capital to the energy complex.

Puru Saxena |

| Home :: Archives :: Contact |

THURSDAY EDITION January 8th, 2026 © 2026 321energy.com |

|