COTs Sour on Natural Gas

By

Alex Roslin

September 12, 2007

www.COTsTimer.Blogspot.com

Will crude oil go to $100? Or is the bull over? Is natural gas finally recovering from its 30-percent smash-up? Or is more bad news coming?

If it's true that the energy markets reflect global economic strength, the latest Commitments of Traders report doesn't look too sunny.

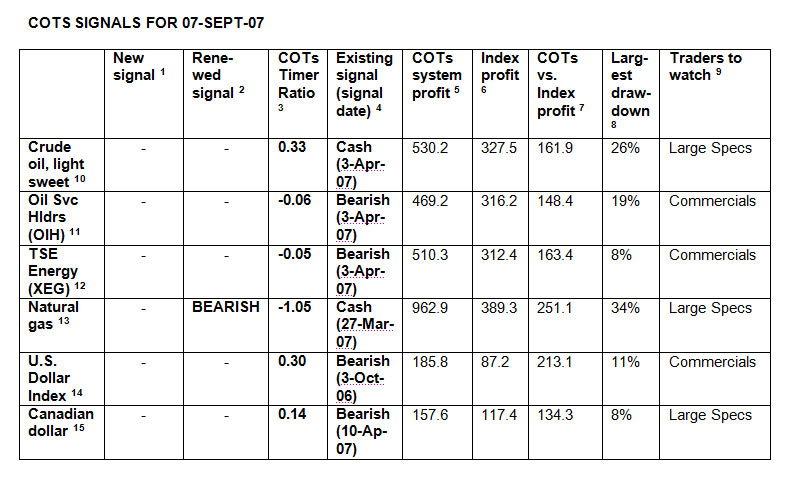

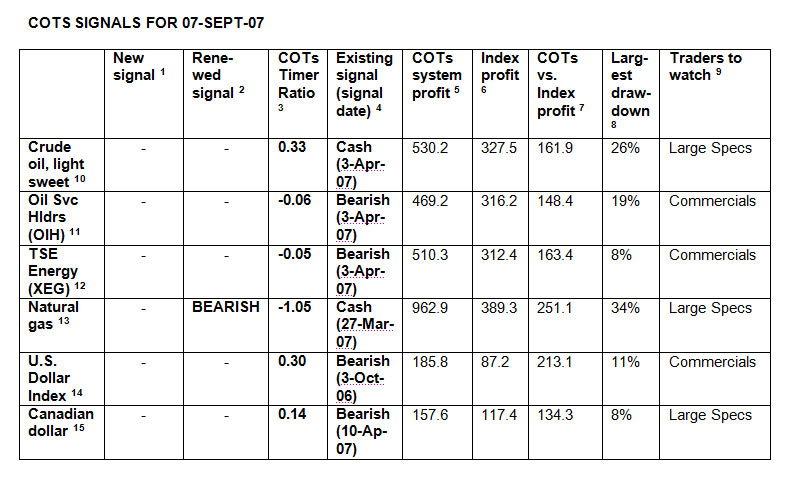

Friday's report-based on futures and options holdings as of Sept. 4-has more sad news for energy bulls. My existing bearish signals for crude oil, energy stocks, natural gas and the Canadian dollar all still hold true. Same for my bearish signal for the U.S. Dollar Index.

This is because traders in these markets didn't registered any new historically extreme positions that would have reversed my existing signals, according to my reading of past COTs data. (See the table below for more details from the latest COTs report.)

As well, in natural gas, the COTs report issued Sept. 7 gave me a renewed bearish signal for this market. This signal is based on trading the same side as the large speculators using the combined futures and options COTs data.

I know what you're thinking. Hold on a sec, Alex. Aren't the large specs the "dumb money" folks who are normally wrong in the markets? Yes, they usually are. My studies of the COTs data show the large specs are indeed the wrong-way traders in most markets-and thus should be faded when they hit historic extremes in their net positions-but in some markets like natural gas they in fact have proved to be the "smart money."

I think my trading setup for natural gas proves this fairly conclusively. The large specs have been on a bearish signal since the March 27 COTs report (which, with my three-week trade delay for this setup, meant the signal took effect on the open of trading on Monday, April 16).

Surprise, surprise-natural gas has given up nearly 30 percent since then. Were the large specs smart or dumb?

I think the natural gas market shows the importance of actually studying the COTs data, rather than reporting fairly meaningless popular notions about it that we often see in the financial media.

Visit my free blog at

COTsTimer.Blogspot.com for my other COTs-based signals in equities, Treasuries, commodities and currencies. Good luck in your trading and investing.

NOTES TO TABLES

NOTES TO TABLES

- Visit COTsTimer.Blogspot.com to see how I trade new signals.

- A "renewed" signal is when a market is already on a buy or sell signal, and traders again register an extreme net trading position in the same direction. The results in this table are based on acting only on new signals.

- The COTs Timer Ratio is my reading of the bullishness or bearishness of traders from the latest COTs report. A reading of 1 or more means a buy signal for the commercial traders or a sell for the large specs and small traders. A reading of -1 or less means a sell for the commercials or a buy for the large specs and small traders. The ratio is based on the traders' net percentage-of-open-interest position compared to the position's moving average divided by the number of standard deviations I use for this setup.

- In parentheses are the dates of the COTs report that gave this signal.

- Past return using the signals of my COTs Timer system, starting from a baseline 100. This is the theoretical return from buying the security on a buy signal and shorting it on a sell signal.

- Past return from buying and holding the underlying cash market, starting from a baseline of 100.

- Ratio of the COTs Timer return versus the underlying market's return.

- Largest past drawdown the setup experienced during a trading signal between the entry price and the lowest price. This was not necessarily the loss at the end of the trade. I use this figure to calculate my maximum portfolio allocation for the setup based on my 2-percent risk threshold of total assets for any one trade.

- The group of traders that had the best historic return in this market. My signals are given when this group reaches specific extreme levels of bullishness or bearishness. Unless otherwise noted, my system trades in the same direction as the commercials and fades the large speculators and small traders.

- All signals are based on the combined futures-and-options COTs data (except for the U.S. dollar index and Canadian dollar). Results for the crude oil setup are based on following the buy signals or being in cash during a sell signal (not being short). No combination of signal rules resulted in a profitable short side of this trade. The win/loss number doesn't include 16 occasions when the setup was in cash.

- Signals for the Oil Service Holders ETF (symbol OIH) are based on a setup correlated to the light sweet crude oil COTs data. OIH price data available only since March 2001.

- Signals for the S&P/TSE Canadian Energy iUnits ETF (symbol XEG.TO) are based on a setup correlated to the light sweet crude oil COTs data. XEG.TO price data available only since March 2001.

- Results for the natural gas setup are based on following the buy signals or being in cash during a sell signal (not being short). No combination of signal rules resulted in a profitable short side of this trade. The win/loss number doesn't include six times when the setup was in cash. This setup is based on trading on the same side as the large specs-not the usual practice of fading this group.

- Signals for the U.S. Dollar Index are based on the futures-only COTs data since Sept. 1992.

- Signals for the Canadian Dollar are based on the futures-only COTs data since Sept. 1992.

By

Alex Roslin

September 12, 2007

www.COTsTimer.Blogspot.com

Disclaimer

This report isn't meant as financial advice or a recommendation to buy or sell any security. Please do your own homework before trading. My system isn't for everyone, involves substantial risk and has experienced large drawdowns in some past trades. Past results are no guarantee of future profits. I'm not a certified financial advisor. While I consider my information to be reliable and accurate, I make no guarantees. Please see COTsTimer.Blogspot.com for other disclaimer information.