|

SATURDAY EDITION January 10th, 2026 |

|

Home :: Archives :: Contact |

|

Precious Metals

|

Dollar Index |

Lucky of Sun |

Dollar Index |

It has been said over and over again that whatever the public wants to invest in or to trade, Wall Street will provide. Be it corn, wheat, sugar, coffee, eggs, cattle, you name it and if there are enough traders asking for it, they shall have it. So saith the leaders of Wall Street and Chicago. Now you can trade and or invest in crude oil in the form of an ETF. It started three days ago. I have posted some information below the crude oil chart. There is very little volume at the moment. I have not seen or read the prospectus. You can trade the UCR, which stands for Up Crude Oil, or the DCR, which stands for Down Crude Oil. As I understand it, they are two different securities. I will be following and posting crude oil charts for those who want to trade the new ETF’s for crude. I’ll use the Delta points and my style and type of wave counting. I have previously written that I believe that crude oil may be entering its fifth wave under the Elliott Wave Theory.

This is the type of activity that may begin to appear fairly soon in the crude oil market.

“In contrast to the stock market, commodities most commonly develop extensions in fifth waves within Primary or Cycle degree bull markets. Fifth wave advances in the stock market are propelled by hope, while fifth wave advances in commodities are propelled by a comparatively dramatic emotion, fear: fear of inflation, fear of drought, fear of war.”……

Elliott Wave Principle

I have hesitated to recommend trading the crude oil contracts because of the risk involved, the expirations, and all of the problems that come with trading commodities. I believe trading the new crude oil ETF eliminates most of those problems. However, I urge you to read the prospectus for this new ETF before you start to trade it. The information I have posted below tells you how to obtain the prospectus.

O.K. What do I think the potential for crude oil is? The answer to that question is a minimum of $130 a barrel. The crude oil chart below shows the wave count as I see it.

Major wave One rose from $10.65 in December 1988 to $36.95.

Major corrective wave Two bottomed at $17.12.

Major wave Three rose in 5 minor waves to a high of $70.85.

Major corrective wave Four was an irregular correction that bottomed at $56.15.

I believe crude oil has now started its Fifth Major wave. Because of the nature of commodity Fifth waves I believe there is an excellent chance that the final high will be at least $130 a barrel. I arrived at that figure by multiplying the size of wave three by 1.382 and adding that figure to the bottom of Major wave Four. Major wave Three was $53.73. 1.382 times that figure is $74.25. I added $74.25 to the Major wave Four bottom of $56.15 and thus we have the potential top for crude oil of $130.25. Crude oil is currently only about $7.00 off of its Major wave Four bottom. That corrective bottom also touched the long term monthly rising trend line.

Sign Central

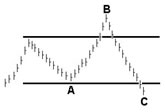

Irregular Corrections

In this type of correction, Wave B makes a new high. The final Wave C may drop to the beginning of Wave A or below it.

Source: Claymore Securities, Inc

Ronald L. Rosen

rrosen5@tampabay.rr.com

December 7th, 2006

| Home :: Archives :: Contact |

SATURDAY EDITION January 10th, 2026 © 2026 321energy.com |

|