|

MONDAY EDITION December 22nd, 2025 |

|

Home :: Archives :: Contact |

|

Where is Alberta? Why Should You Care?Peter McKenzie-BrownEmail: pmbcomm@hotmail.com languageinstinct.blogspot.com October 27, 2007  Can it really be true that, $90 per barrel oil notwithstanding, the Canadian petroleum industry is facing an economic downturn?

Can it really be true that, $90 per barrel oil notwithstanding, the Canadian petroleum industry is facing an economic downturn?

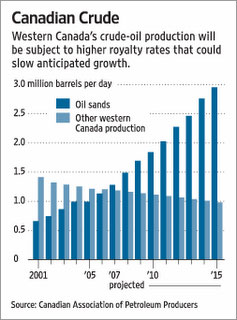

It is true, and you should care. Traditionally ignorant about things Canadian, Americans in particular should understand the critical economic issues now facing Canada’s petroleum industry. A kahuna is a priest, sorcerer, magician, wizard, minister or expert in any profession, and Canada is the petroleum kahuna on America’s doorstep. If we do not perform our production magic well, the energy world should worry. Canada is by far the largest source of imported oil for America, and one of the few large oil producers with the potential to keep increasing oil production well into the future. The US Energy Information Administration has identified Canadian reserves as being second only to those of Saudi Arabia. So if you worry about peak oil and the world’s energy future, you would be foolish to ignore the geopolitics and energy economics that are racking Canada today. Canada's petroleum industry is facing a perfect storm of ill effects. These are five in number: First, the Canadian dollar is at its highest level against the dollar in 30 years. Second, the natural gas industry is in the tank. Third, environmental issues are getting critical. Fourth, industrial inflation is rocketing out of sight. And finally, governments have become greedy - very greedy. Let’s look at these points one at a time. 1. Exchange Rates: Since 2001, the Canadian dollar has risen from just over 60 cents per US dollar, when our loonie was called the "northern peso", to $1.04 today. During the same period, oil (priced in US dollars) has tripled in value. These parallel movements have had some curious effects. Oil prices for Americans have more than tripled, based on nominal, US dollar, prices. In Canada, however, they have "only" doubled. That's a big increase, of course, but it's more modest than in the rest of the world. On the one hand, consumers have been hit much harder in the United States than in Canada. On the other, American oil companies have benefitted far more from oil price increases than those in Canada. And since Canadian oil companies have profited much less, they have less capital for exploration and development than you might expect. Put another way, foreign exchange movements have made crude oil less profitable to develop and produce. The industry thus has less incentive to develop it. 2. The Natural Gas Sector: Forecasters now commonly suggest that western Canada's conventional gas production has peaked and will continue to decline. The reasons are complex, but part of the reality is that Canadian producers can’t sell their gas at the prices American producers command. The $7 futures contract for gas on the NYMEX is not reality in Canada. In Western Canada, our producers get $5 per thousand cubic feet for their gas, while the cost of finding and developing the stuff is in the $7-$9 range. Once again, this means less capital for investment in domestic reserves. 3. The Environment: Global concern about climate change is leading to higher taxes on crude oil, most of it imposed at the retail level. In Canada, this includes transit taxes in the cities of Vancouver and Montreal, and – effective this month – a carbon tax in Québec. Retail taxes are not a concern for the oil producers, except to the extent they are inflationary. However, tough environmental rules in the upstream are creating a lot of problems for producers. They increase costs and they delay project development. No one disagrees with the importance of good environmental regulation, but good regulation does not come cheap. It costs both time and money. Environmental regulation is adding to inflation and delaying the onset of oil production that is increasingly critical. 4. The Boom: The general boom in Alberta is also contributing to oil patch inflation. The province hosts most of Canada’s petroleum production, and is the North American jurisdiction with the lowest unemployment rate. In this province the petroleum sector faces rapidly escalating costs in almost every area. Office space in Calgary, the industry’s geographic centre, has quintupled in five years. Labour for oil sands development is astronomical. Productivity is declining. How can there be an economic boom when the basic economics of conventional oil and gas production are in decline? The main reason is that conventional reserves, which were drilled in an era of lower costs, are now getting produced and sold as quickly and profitably as possible. High prices for oil are accelerating the resource’s depletion. Costs for drilling and mineral rights have declined in the last year, but that is hardly cause for celebration. It has happened because the industry is less inclined to drill. That is something to worry about: If you don’t drill, you don’t find oil. 5. Greedy Government: The final piece of this puzzle is the matter of royalties and taxes. In Canada, oil and gas reserves are mostly owned by government, and governments get revenue from producers in a variety of ways – primarily economic rent (royalties), sales of mineral rights, and a variety of taxes. In response to voters who are convinced high oil prices mean high profits for oil producers, Canadian governments are finding ways to increase their take from the sector. This is their right and privilege, of course. However, the more the industry has to pay, the less oil it is going to produce. Today, things took a decidedly ugly turn for the petroleum industry in Alberta, the province that produces about 90 per cent of Canada's oil. The province has no debt, and runs a huge fiscal surplus every year: This year it is projected to be $2.2 billion. Its great wealth notwithstanding, the provincial government announced a much-dreaded new royalty framework that will boost royalties by $1.4 billion per year (20 per cent) in 2010. The new rates, which will increase maximum royalties from current highs of 35 per cent to 50 per cent for conventional oil and natural gas, won't take effect until 2009. In the critical area of a regime for oil sands development, the system also changed. The current royalty is 1 per cent per year on gross revenue until a project recovers its multi-billion dollar investment. The royalty then rises to 25 per cent of revenue minus operating and other costs. Under the new regime there will be a sliding tax which starts increasing at $55 a barrel. Assuming current prices, oil sands royalties will be about 5 per cent before payout and 33 per cent thereafter. The maximum rate will be 40 per cent.  Outcome: The chart projects Canadian oil production based on the first of these two royalty regimes. Rest assured that under the new arrangement future oil production from both conventional and oil sands resources will be less than the volumes projected, all else being equal.

Outcome: The chart projects Canadian oil production based on the first of these two royalty regimes. Rest assured that under the new arrangement future oil production from both conventional and oil sands resources will be less than the volumes projected, all else being equal.

In a world anticipating peak oil, making oil production less profitable is a serious matter. By definition, the new fiscal regime will make oil and gas production less profitable. Love ‘em or hate ‘em, oil companies are governed by the rules of capitalism. They put their money where it will generate the best return. Canada, which has a strategically vital place in the world petroleum industry, is the world's seventh largest oil exporter, but also the seventh largest importer. In most of eastern Canada, the refining side of our industry finds it cheaper to import oil from overseas, paying for it with our strong currency. When you have a strong currency, you have more options. Canadian producers will increasingly invest in production from riskier but more profitable exploration provinces - for example, in Southeast Asia - at the expense of secure investment in North America. We should worry about this, and worry a lot. Peter McKenzie-Brown Email: pmbcomm@gmail.com languageinstinct.blogspot.com October 27, 2007 |

| Home :: Archives :: Contact |

MONDAY EDITION December 22nd, 2025 © 2025 321energy.com |

|