|

SATURDAY EDITION January 31st, 2026 |

|

Home :: Archives :: Contact |

|

Oil Market UpdateClive Maund support@clivemaund.com November 19, 2008 With its latest drop last week oil has finally arrived at the upper end of our target zone in the low to mid $50's. This means that it has lost an astounding 62% in just 4 months - it is the sort of loss more usually associated with poor quality stocks rather than the "lifeblood of the modern world", which is what oil is. The reasons for it are now common knowledge - forced liquidation by leveraged speculators and the fear of an impending recession/depression. Just as the pendulum swung too far on the upside it has now swung too far on the downside, especially as politicians and world leaders have made it abundantly clear by their actions in recent weeks that they are going to inflate, and already are in grandiose fashion in order to save their hides, at least temporarily, from the consequences of a deflationary implosion.

On the 3-year chart for Light Crude we can see that the price is now arriving at the downside target projected from the Head-and-Shoulders top pattern, above which there is significant support arising from the early 2007 low. The precipitous decline from the highs has resulted in an extremely oversold condition which even given the worst case scenario of a plunge into a deflationary abyss would be expected to lead to some sort of recovery rally shortly, so given the unbridled inflation scenario which is being shamelessly pursued it is reasonable to expect a reversal and sizeable uptrend to develop soon, especially if the dollar spike burns itself out. The MACD indicator has recovered somewhat from its extraordinary oversold extreme at the end of last month, but only because the price has been dropping at a reduced rate. Meanwhile the now gigantic gap with the 200-day moving average, which exceeds that at the other extreme last July by a considerable margin, clearly creates the potential for a sizeable rally.

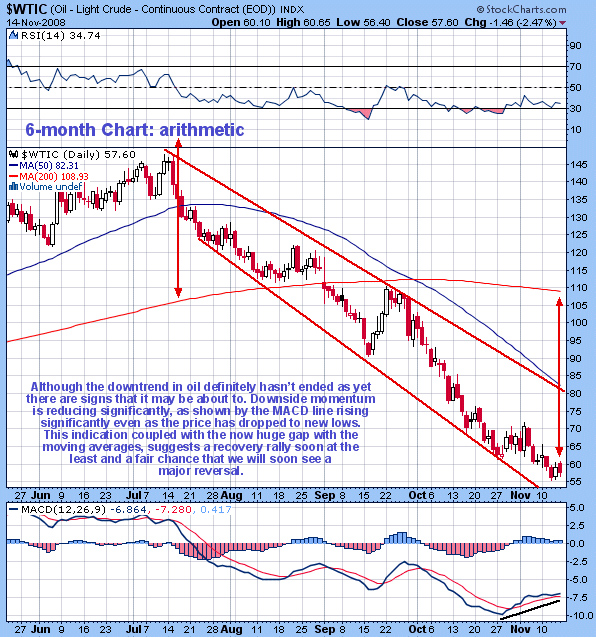

On the 6-month chart we can see that while the downtrend from the highs definitely isn't over, there are several indications that a reversal is likely soon. The MACD indicator is still at a deeply oversold level, and even though the price has continued lower over the past week or so, the MACD has actually been climbing showing that downside momentum is waning, a situation that could lead to a sudden reversal, especially given the huge gap with the 200-day moving average.

Clive Maund November 19, 2008 support@clivemaund.com Clive Maund is an English technical analyst, holding a diploma from the Society of Technical Analysts, Cambridge and lives in The Lake District, Chile. Visit his subscription website at clivemaund.com .[You can subscribe here]. Clivemaund.com is dedicated to serious investors and traders in the precious metals and energy sectors. I offer my no nonsense, premium analysis to subscribers. Our project is 100% subscriber supported. We take no advertising or incentives from the companies we cover. If you are serious about making some real profits, this site is for you! Happy trading. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis. Copyright © 2003-2008 CliveMaund. All Rights Reserved. |

| Home :: Archives :: Contact |

SATURDAY EDITION January 31st, 2026 © 2026 321energy.com |

|