|

FRIDAY EDITION May 9th, 2025 |

|

Home :: Archives :: Contact |

|

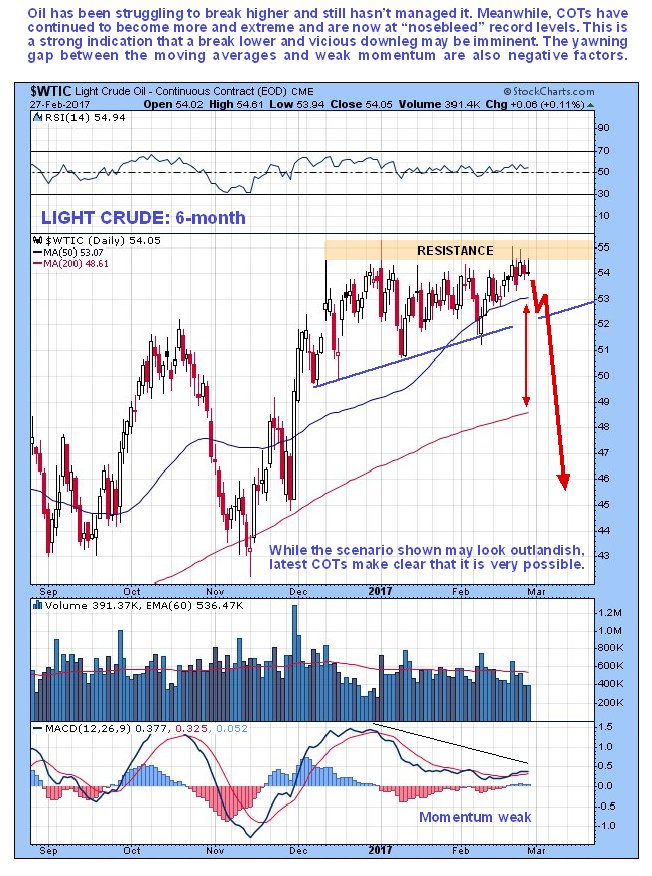

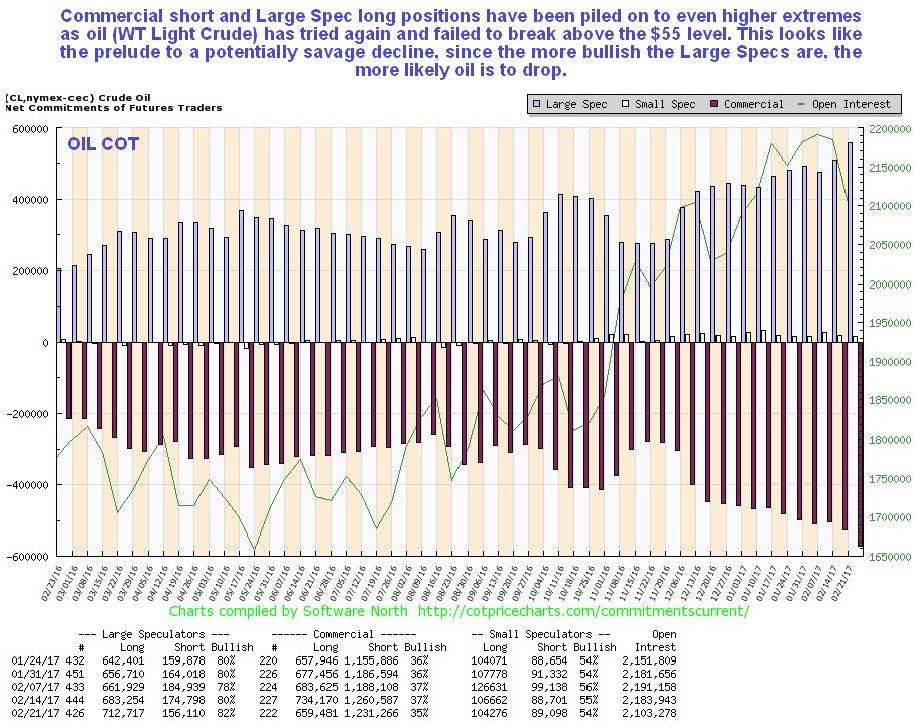

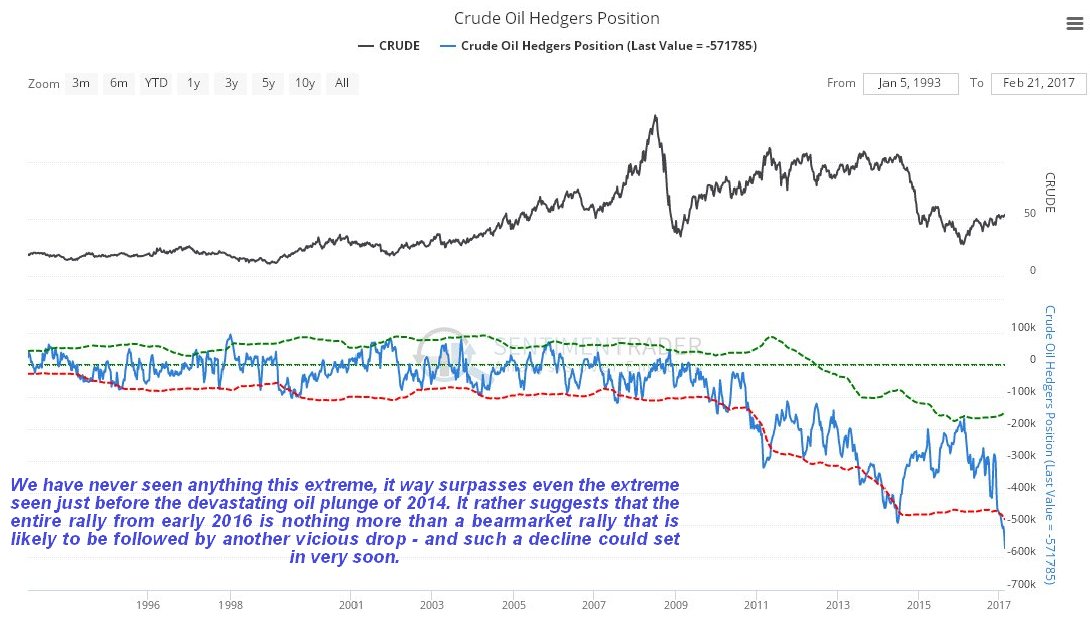

Oil Market Interim Update - You Won't Get A Clearer Warning Than This One...Clive Maund support@clivemaund.com March 4th, 2017 This quick update on oil is to point out that the latest oil COTs and Hedgers positions were at frightening extremes, as oil has struggled and failed thus far to break higher. This is viewed as meaning trouble, BIG TROUBLE for the oil market, where we could see a precipitous drop as in 2014. First we review the latest 6-month chart for Light Crude, on which we see that oil has tried again to break above the line of resistance in the $55 area at the top of a triangular range, and so far failed, and the quite large gap between the moving averages and weak momentum (MACD) are viewed as additional bearish factors…  On oil's latest COT chart we see that the usually wrong Large Specs are raving bullish, while the Commercials now hold record heavy short positions...  Meanwhile the latest Hedgers chart, which is a form of COT chart going back much longer, shows positions at "off the scale" extremes. Even right before the 2014 bloodbath, they were not as extreme as they are now, and they were seriously extreme then.   The conclusion to all this is that a brutal decline in the oil price could be just around the corner, and the heavy drop in GDX today suggests that gold and silver are about to get taken down too (gold is completing a bearish Rising Wedge). Copper COTs call for a copper price smash too. End of update. Clive Maund March 4th, 2017 support@clivemaund.com Clive Maund is an English technical analyst, holding a diploma from the Society of Technical Analysts, Cambridge and lives in The Lake District, Chile. Visit his subscription website at clivemaund.com .[You can subscribe here]. Clivemaund.com is dedicated to serious investors and traders in the precious metals and energy sectors. I offer my no nonsense, premium analysis to subscribers. Our project is 100% subscriber supported. We take no advertising or incentives from the companies we cover. If you are serious about making some real profits, this site is for you! Happy trading. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis. Copyright © 2003-2017 CliveMaund. All Rights Reserved. |

| Home :: Archives :: Contact |

FRIDAY EDITION May 9th, 2025 © 2025 321energy.com |

|