|

THURSDAY EDITION March 12th, 2026 |

|

Home :: Archives :: Contact |

|

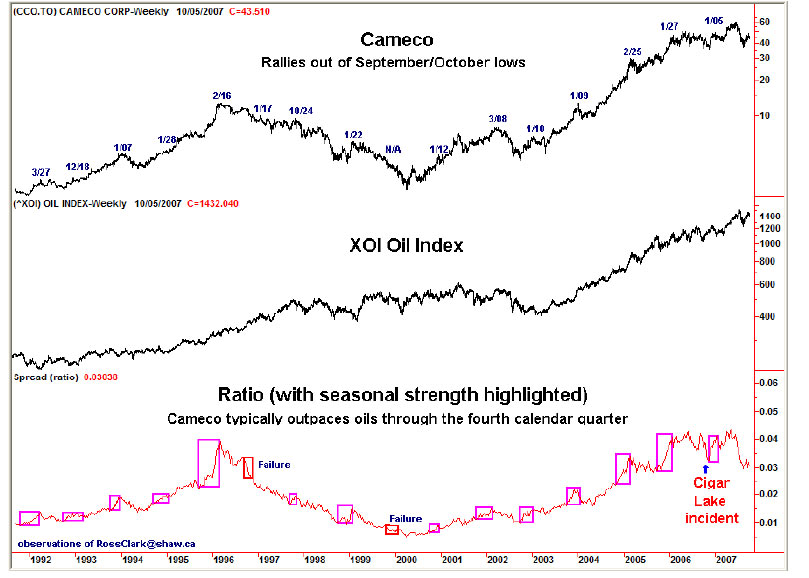

Uraniums Are Scheduled to Outpace OilsBob HoyeOctober 7, 2007 Uranium stocks have a tendency to consolidate after nineteen to twenty-one weeks of selling pressure. For most uraniums the August 16th panic low came within that time window. The majority of the lower priced issue have rallied by 40% to 60% from the closing low, but found resistance around their 50 and 200 day moving averages (and still well below the April and July highs). History shows that the panic lows are usually tested seven to nine weeks later, providing a targeted time window from now through October 19th. The strongest equities in the sector should establish a ‘bullish step-up’ or divergence in the volume and relative strength oscillators. Such a test would also coincide nicely with the standard seasonal characteristics. Over the years we’ve outlined it as follows: “Using Cameco (CCJ, CCO.TO) data from 1991 compared to the XOI index it is readily apparent that the ratio finds a low in the last two weeks of September through the first ten days of October. From there Cameco outpaces on the upside for the next twelve to sixteen weeks.” In most years the rally extended well into the first quarter of the following year.  Bob Hoye October 7, 2007 INSTITUTIONAL ADVISORS EMAIL:: bobhoye@institutionaladvisors.com CHARTWORKS WEBSITE:: www.institutionaladvisors.com

The opinions in this report are solely those of the author. The information herein was obtained from various sources; however we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance.

|

| Home :: Archives :: Contact |

THURSDAY EDITION March 12th, 2026 © 2026 321energy.com |

|