|

TUESDAY EDITION January 6th, 2026 |

|

Home :: Archives :: Contact |

|

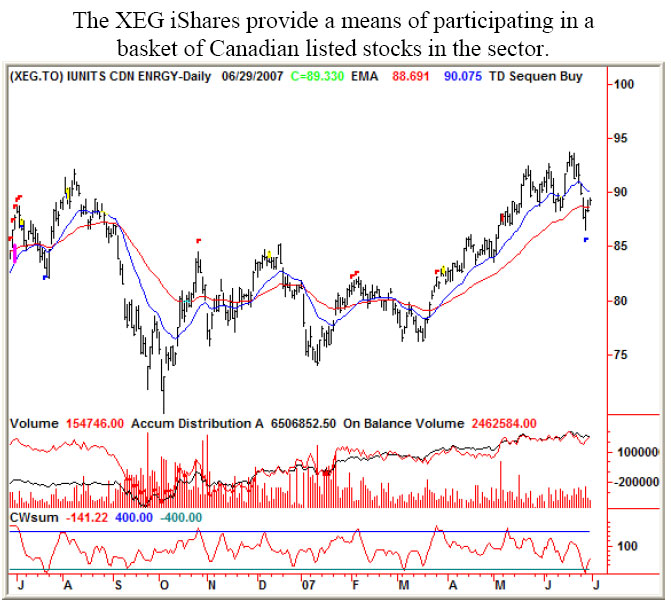

Natural Gas & Crude OilChartWorks: published by Institutional Advisors Bob Hoye July 8, 2007 Technical observations of RossClark@shaw.ca Oil stocks are entering a sweet spot in their seasonal pattern. In years such as this when the crude oil price maintained a flat to rising trend through the seasonally weak period of late May-late June the related stocks (XOI index) exhibited short-term pullbacks that were concluded by the end of June. (In years with weak crude prices the XOI lows were seen three to six weeks later). Most stocks in the sector went through minor corrections in June and reversed higher at the end of the month. Now that we have the first week with a higher close traders can be long and control risk with a stop below the June lows. In 18 of the past 23 years the XOI exhibited strength into September-October. In the ten years where lows were in place by the end of June the average rally was 12% (in a range of 5% to 23%).

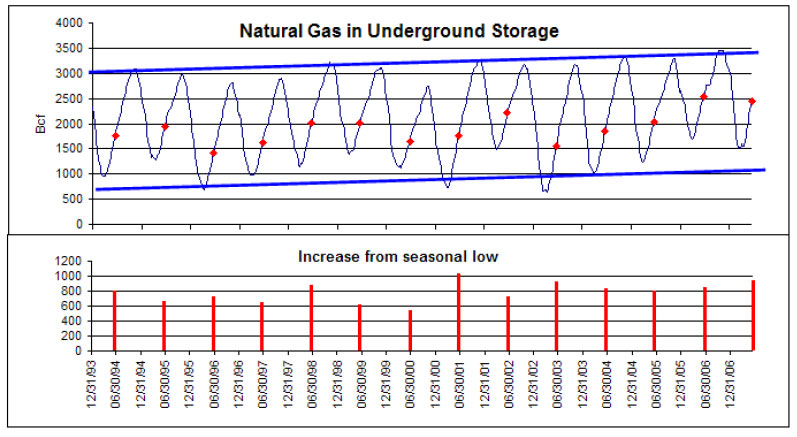

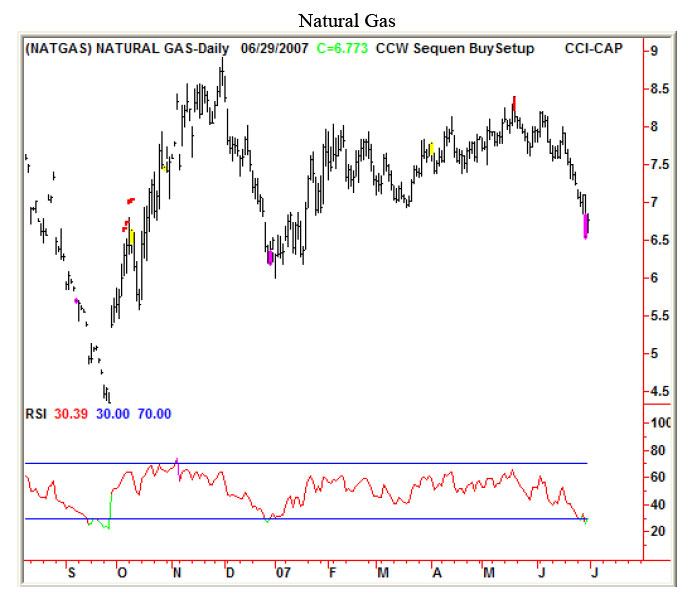

Natural Gas Inventories of natural gas rose at an above average rate in the second quarter and the price is going through its appropriate seasonal decline. Barring any hurricane related activity in the gulf, the commodity price and the gassier stocks will likely remain capped until late in July. Our price target for the fourth quarter is $12.25+.

BOB HOYE, INSTITUTIONAL ADVISORS July 8, 2007 EMAIL bhoye@institutionaladvisors.com WEBSITE www.institutionaladvisors.com

|

| Home :: Archives :: Contact |

TUESDAY EDITION January 6th, 2026 © 2026 321energy.com |

|