|

FRIDAY EDITION May 9th, 2025 |

|

Home :: Archives :: Contact |

|

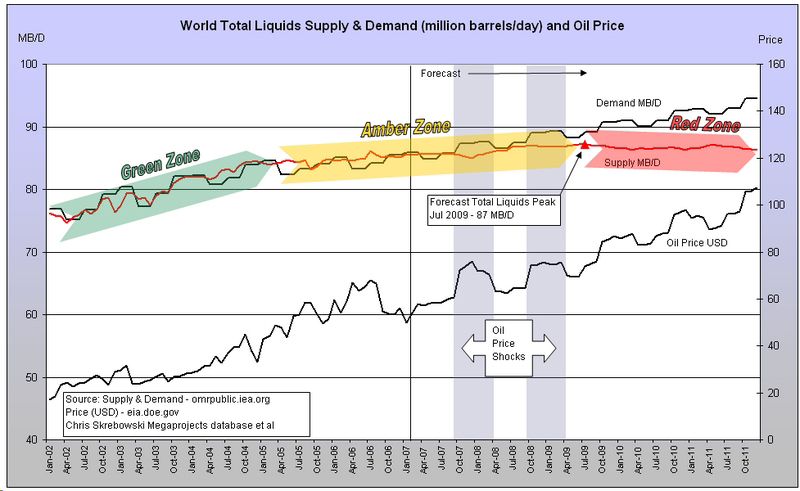

Supercycle BusterDave DuBynewww.daveseslbiofuel.com daveseslbiofuel@gmail.com November 12, 2007

This graph by Chris Skrebowski compares volumes of oil coming on stream to global oil depletion. You can’t really talk about economic expansion today without muttering a sentence or two about a commodities supercycle. To a large extent, growth in the BRIC countries – Brazil, Russia, India and China – are fuelling this supercycle by gobbling up ever-greater shares of the world’s available resources. Let's put that in perspective. If you sift through history and study its cycles, you will find a telescoping of linear time. Each era is becoming shorter than the last. The agricultural revolution lasted 7000 years. The scientific revolution took 400. The industrial revolution took a mere 150 years. Wiring our planet with copper cables to transmit and receive messages took the century that ended in the 1980s, while rewiring it with optical cable took only a couple of decades. The speed of global messaging went from years in Magellan’s time to immediacy by email. The telescoping of time cycles appears to be the norm rather than a perfect set of coincidences. Perhaps this commodity supercycle will be the shortest cycle of them all. Perhaps peak oil will bring on its collapse. Enter the Dragon: Here in China, there is a palpable frenzy of about the birth of a new commodities supercycle driven by the BRIC countries as they industrialize and modernize. That takes a lot of material and newly created money. In the last 130 years, there have been three commodity supercycles – periods of intense demand and rapid price escalation. The first lasted from the 1880s to the 1920s – 45 years – and was followed by the Great Depression. The era of post-war reconstruction lasted from 1945-75 – 30 years – and sank into the dismal morass of stagflation. The new supercycle began barely five years ago. Will it be shorter than the last? How will it end? China’s economy is at least 50 per cent manufacturing driven. New foreign direct investment, joint ventures and factory construction is the main force behind expanding internal demand for commodities. It’s the factory owner who is purchasing the new apartment, the factory manager who is buying the latest-model car, the factory employees that go to stores and buy drinks in plastic bottles from hyper-marts or corner stores. As the world shifts its plants to China and buys Chinese goods, it puts newly created money into the society. This allows the average family to buy once unobtainable products. Stores, real estate and stock markets are booming as new money created in the last five to ten years trickles down. And that money relies on manufacturing and export. Think of all of the industries and enterprises involved just to keep the supply chain of raw materials and energy flowing to factories so they can continue to manufacture the world’s goods. Everyone involved with logistics and freight forwarding, construction, computer networking, materials importers, middle men, trickling all the way down to the uniform producer for the factory workers themselves and the snack truck at the front gate. They are all involved and now heavily dependent on low energy prices to be able to sell goods and services to foreign markets. As the cycle continues, it generates wealth that drives internal consumption that keeps the cycle going. In the worldwide commodities supercycle, China is behind the wheel Supercycle Buster: If the buying outside China stops, so will its internal consumption. The supercycle buster will be a reduction in manufacturing orders from other countries also affected by constricting economies in recession or depression due to soaring prices for fuels and other commodities. China is highly vulnerable to and dependent on a system that relies on the consumption of manufactured by customers outside its borders. The Shenzhen, Shanghai and Hong Kong stock markets are pulling in billions of dollars in IPO offerings for a host of Chinese companies. If the global monetary base begins to contract under the weight of soaring oil prices and the gathering global credit crisis, many of China’s listed companies will lose market value and stock prices will slip. The Chinese are the world’s great savers, but their savings will be lost. Disposable income inside China will shrink. So will demand for commodities. The present commodities supercycle will end in a world in which power black-outs are a regular daily occurrence and fuel supplies have been rationed, and only then will sustainable alternative energy sources be considered. Now that China has more than doubled its oil imports compared to the last five years, they are as dependent upon the black liquid as those outside this country. Minicycles Within the Supercycle: I see a quick end to the present base metals supercycle. I also see two minicycles before the actual collapse of the present global economic paradigm. As you can see in the graphic at the beginning of this article, oil prices started to rise on schedule with the forecast of deficient oil supply versus demand. The first minicycle will run from October 2007-April 2008. Prices will skyrocket, plateau sometime around December 2007, stay at their lofty levels for three months, then decline around April, 2008. Using this pricing model, after we come off of the “high” prices we will return to oil in the "inexpensive" 90-dollars-per-barrel price range. China will have greatly reduced factory orders during the high plateau from December 2007 to March 2008. That will trickle down, reducing consumption for all purchasable products within China. The second minicycle will begin in late September 2008 and repeat the same pattern until April 2009. If depletion forecasts from the Association for the Study of Peak Oil (ASPO) are accurate, after that point the world will be unable to balance supply with the optimum demand needed for sustained economic growth. During the two minicycles there will be an enormous amount of money made in a short period of time. Prices of commodities and materials of every conceivable type will be at their highest levels ever as oil will be at its highest price ever as well. It will last for a short while, and then demand destruction will take its toll worldwide. An age of insufficiency is beginning. The super-contractionary phase of the world economy is getting underway. Only the economies of the large oil-producing regions of the world will prosper. As this supercycle slides to a halt, I believe we will begin to think differently. Instead of focusing on consumption and profit, perhaps our mind-set will shift toward conservation, durability and sustainability. If we don’t, it will be because we have not learned from our past. Dave DuByne www.daveseslbiofuel.com daveseslbiofuel@gmail.com http://languageinstinct.blogspot.com November 12, 2007 David DuByne is from the United States and is presently living and teaching Business English in Chongqing, China. He and webmaster Marc Hastenteufel are translating www.daveseslbiofuel.com, an English teaching web site devoted to bio-fuel and oil depletion, for those studying English around the planet into Mandarin Chinese. Robert Rapier, an expert on cellulose ethanol, gas-to-liquids (GTL), and butanol production, also provides technical assistance for content throughout daveseslbiofuel in the renewables and conservation section. |

| Home :: Archives :: Contact |

FRIDAY EDITION May 9th, 2025 © 2025 321energy.com |

|