|

THURSDAY EDITION February 26th, 2026 |

|

Home :: Archives :: Contact |

|

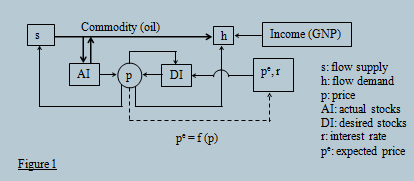

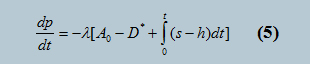

Some Analytical Aspects of the New Oil Market (Part 1)Professor Ferdinand E. Banksferdinand.banks@telia.com December 6, 2007 The University of Uppsala, Uppsala Sweden The School of Engineering, Asian Institute of Technology, Bangkok Thailand Abstract: A short time ago crude oil was well on its way toward a price of one hundred dollars a barrel (= $100/b) - a level which, as Björn Lindahl (2007) noted, was once thought to be a signal for the imminent collapse of the international macroeconomy. To be exact, the price on the New York Mercantile Exchange (NYMEX) touched $99.29/b, while Brent oil reached $96.40/b. In my new energy economics textbook (2007a), I tried to explain why this was inevitable, but some technical details were excluded. Examining several of these omissions both verbally and with the help of some mathematics is one of the purposes of this paper, which means that to some extent it is a complement to my less technical contribution 'The Architecture of World Oil (2007b). I also use this opportunity to review some elementary aspects of futures and options markets, and readers without an interest in algebra and integral calculus should skip the second section and turn to these materials after perusing the long introduction. The sections in this paper are 1. A long introduction; 2. Some technical issues 3. Introducing oil futures; 4. some aspects of options; 5. Final observations and conclusions. KEY WORDS: peak oil, futures, options, stocks, refining and petrochemicals 1. A LONG INTRODUCTION On March 4, 1974, a highly conspicuous Nobel Laureate, Professor Milton Friedman, was able to provide the readers of Newsweek with the joyful tidings that "… the world oil crisis is now past its peak. The initial quadrupling of the price of crude oil after the Arabs cut output was a temporary response that has been working its own cure." Furthermore, he chose to inform his audience that "…even if they [OPEC] cut their output to zero, they could not for long keep the world price of crude at ten dollars a barrel (= $10/b). Well before that point the cartel would collapse." And, presumably, the price of oil would come tumbling down. (Crude oil is conventional oil that flows directly, and usually without processing, from the ground. Unconventional oil includes shale oil, oil from tar sands, (extra) heavy oil, such as the kind found in large quantities in Venezuela, and also synthetic oil, which e.g. might be manufactured from coal. The oil from tar sands has also occasionally been labelled a synthetic oil.) A few days ago the market price of oil was quoted at more than $99/b, which means that it had increased by 73% from the $61/b registered at the beginning of 2007, and Friedman's assurances notwithstanding, no intelligent person believes that the Organization of Petroleum Exporting Countries (i.e. OPEC) will be unable to continue riding the crest. Furthermore, as I have pointed out in many papers and lectures, and especially in my new energy economics textbook (2007), these countries have finally become proficient in playing the oil market game, which means that they are no longer concerned with the consequences of hypothetical 'cures': they have discovered a new strength in the light of the unique and immutable value of oil to the large importers of that commodity, and in addition the present and future value of domestically produced oil as an input in their own consumer and industrial activities - for example petrochemicals. (Note the expression "market price". There is a difference between this price and the real price, where the latter is the market price adjusted to account for things like inflation and exchange rates. Actually, this difference is less significant than commonly believed.) The Russians have also learned how to use their leverage. Before continuing, I can confess that three decades ago I predicted that the present oil price situation could not be avoided, and I was not alone in my pessimism. Professor Edward W. Erickson (1985) stated that "Over the longer term, however moderate demand growth may be, it will confront an inexorable decline in the production capacity of currently proved reserves, combined with reserve additions that will on average be less than production. This is ultimately the receipt for a tightened market." The expression "on average" was unnecessary, because in l980-81 global discoveries were already less than global production for the first time since the opening of the modern 'oil age', and the "moderate demand growth" he alluded to is now being dramatically boosted by the energy needs of China and India. Slightly earlier, Harry Saunders told readers of his paper (1984) that "the return of higher oil prices is inevitable", and so I think that these anticipations call for citing one of my favourite quotation, which originated with Benjamin Franklin about the year 1800: "Experience is an expensive school, but the only one in which fools can learn." Having mentioned petrochemicals, I would like to take this opportunity to inform interested persons what I believed (and still believe) will be the future of that industry, where refined products manufactured from oil and gas are the main inputs. (And where, according to GOOGLE, these chemicals have "had a dramatic input on our food, clothes, shelter and leisure" - which sounds right, since there are over 4000 products classified as petrochemicals.) In my oil book (1980), I made the following unpopular statement about the petrochemical intentions of Saudi Arabia. "These are ambitious targets, and it will be interesting to see if they are realized, or even partially realized. Because if they are, it signifies an important breakthrough on the development front: the ability of a less developed country (albeit a rich LDC) to mobilize in less than a decade, the capital and skill necessary to challenge some of the industrial giants of Europe on their own turf." Another disturbing observation I offered was that as petrochemical and non-oil revenues in the Middle East increase, revenues from the sale of crude oil lose some of their significance. But even so, a high price of oil means that countries like Saudi Arabia will not only find it possible to enjoy high export incomes, but at the same time conserve larger amounts of their irreplaceable oil resources. In case readers require an example, Gapper (2007) cites oil rich Dubai, which has diversified to a point where only five percent of that country's gross domestic product comes directly from oil. In my course on oil and gas economics at the Asian Institute of Technology, I insisted that everything worth knowing about the past and future of the world oil economy can be ascertained from a careful study of the supply of and demand for conventional and unconventional oil in the United States. That country is still the leading consumer of oil, while at one time it was also the leading producer, which meant that oil naturally became an indispensable component in the building and configuration of the U.S. economy. Oil may be more important today than ever, however the output of that commodity in the 'Lower 48' peaked at the end of l970, and even though the giant Prudhoe field (in Alaska) came on stream a few years later, the resulting upturn in total production could not be sustained: the l970 peak was never exceeded, and the U.S. now imports almost 11 mb/d of its total consumption of 21 mb/d! (It should also be noted that the discovery of oil in the U.S. peaked about 1930!) In other words, despite the fact that only a small fraction of the area of the United States provided millions of barrels a day, intense exploration was unable to locate appreciable new quantities of conventional crude oil in the 'lower 48' or Alaska. That observation also applies to nearby Canada and Mexico. Moreover, it is generally - but tacitly - recognized in the executive suites of the major oil firms that this situation would not be materially altered if environmental restrictions were abolished, and with state-of-the-art extraction technology it became possible to lift oil from every onshore or offshore region over which the United States exercises authority, or for that matter far offshore regions for which property rights have not or cannot be established, and the extraction of resources functions on a first-come first-serve basis. The inhabitants of executive suites in the oil industry are in possession of other 'secrets' that they prefer not to circulate, one of which is that the forecasts of the International Energy Agency (IEA), and United States Department of Energy (USDOE) are completely without any scientific foundation. Only a director of the French major 'Total' has deigned to broadcast this unfortunate state of affairs. According to Dr Nick Butler, director of the Cambridge Centre for Energy Studies, "most oil executives believe that conventional oil supplies will find it hard to reach 100mb/d". This is not something that we should be anxious to hear, because with the present demand for (conventional + unconventional) oil at approximately 85 mb/d, we could encounter a peaking of conventional oil between 2015 and 2020, or even as early as the 2013 date that certain sources close to the French government apparently have predicted. There has also been a failure in the U.S. to increase the average recovery rate - or the ratio of extractable oil to oil in place. When I published my oil book this was about 30 percent, which meant that of every 100 barrels of oil positively identified, on average only 30 barrels could be extracted. The global value of this quotient was about 0.32 (although this varied greatly between regions), and by the turn of the century was not much more than 0.35. But even so, at the Rome meeting of the International Association for Energy Economists (IAEE) in 2000, several so-called oil experts expressed the bizarre opinion that at any moment there would be a dramatic increase in this fraction, and as a result a healthy downward pressure would be placed on the price of oil. Thirty years ago it was estimated that the worldwide recovery ratio would eventually average 40%, however what was missed both then and now is that this bounty is unlikely to take place in the major consuming countries. On the basis of my previous experiences, I feel certain that at forthcoming meetings of the IAEE , those same experts will be effusive in their description of the shale oil industry in the United States, now that that industry seems to be edging into the limelight again. According to Jon Birger (2007), there is three times as much oil in the shale of Colorado and Utah as there is in Saudi Arabia, and so from the point of view of reserves this observation suggests that the U.S. enjoys the same energy status as the entire Gulf region. He envisions shale as not only an energy reserve of enormous future value, but in addition one that can reduce the "risk premium" built into U.S. oil imports because "energy traders could rest easy knowing that the flow of oil from Colorado or Utah won't be cut off by Venezuelan dictators, Nigerian gunmen, or strife in the Middle East." I certainly hope that governments disregard Mr Birger's wisdom, because this is the kind of drivel associated with the sub-prime mortgage fiasco that led his employers at Fortune to ask what some of the "best minds on Wall Street" were smoking. Any "trader" who is inclined to rest easy and accept that kind of infantile bunkum could find himself or herself prematurely resting easy in their ski lodge in Aspen (Colorado) or Åre in northern Sweden. The risk-premium in this context is a concept that applies to the short run - e.g. the short run pricing of oil in auction type markets such as NYMEX, where the main issue is not the next few years but the next few minutes. When traders sell because a major oil exporter promises to increase production in the near future, it is not because they believe that this will happen, but because they think that other traders will sell. I can also note that Birger mentions a USDOE report which predicts an output of shale oil in 2020 of 2 mb/d. This may sound nice to some, however even if realized it is inadequate. That much 'extra' oil is needed immediately - i.e. before an 'anomalous' event somewhere sends the oil price into orbit. Finally, the refining sector should not be neglected, because the absence of capacity in that sector has often been blamed for what has been called the high price of motor fuel in the United States. Apparently, it has been about thirty years since a new refinery has been built in that country. From the point of view of academic economics, this absence of investment makes a certain amount of sense. Refining is one of the riskiest of all industrial activities, and with the exception of the brilliantly managed (or lucky) Valero Refining in the U.S., the most consistent winners in this line of work tend to be the large integrated oil companies whose production of crude enable them to support refining losses. Moreover, in the same vein as noted with petrochemicals, the center of gravity of refining might also belong in the Middle East. Personally, I find it hard to believe that it makes more economic sense to export oil from the Middle East to places like India, where it is refined and then re-exported. The same applies to major refining hubs like Singapore, Rotterdam and South Korea. Refineries produce oil products with various characteristics from their main 'feedstock', which is crude oil. In a typical 'cut' or 'fraction' we find kerosene and fuel oil, gasoline and diesel, lubricating oils, light and medium products such as naptha which are inputs for the petrochemical industry, and at the heavy end asphalt. Where the quality of feedstocks are concerned, 'light' crude is best, but as bad luck would have it, crudes are tending to become heavier. There is also a distinction between low sulphur oil, which is called sweet crude, and high sulphur oil, which is called sour crude. Refiners can vary the product 'cut' by using different feedstocks, and to a certain extent by altering the temperature and pressure in the 'distillation column', which is probably the nucleus of a refinery, but in accordance with the laws of mainstream economics, extensive alterations require expensive investments. Many of these investments were made before high oil prices put an end to high profits for independent refiners. In the U.S. it has become more difficult to pass on high input prices to buyers of oil products, and especially motor fuel. Thus the so-called 'crack spread' - which is the difference between the price of a barrel of crude and a barrel of refined products - is being reduced once more. In later sections of this paper readers get an elementary look at futures and options, and a more advanced analysis might suggest how a sophisticated use of derivatives (e.g. futures and options) can alleviate some of the pain associated with declining crack spreads. I am very positive about the use of derivatives (except in the case of electric derivatives), but I have seen no evidence that they have provided the refining sector with more than a modicum of protection. 2. SOME TECHNICAL ISSUES This section - which many readers might prefer to avoid - consists of a number of observations and manipulations of a technical nature. As usual readers will find the stock-flow model that I have used in almost all my work, since now it is generally understood that inventories are the key item in short-term pricing in the oil market. Some question must be asked as to why this has not been understood by other authors, because their unshakable belief in the early chapters of their favourite Economics 101 textbook, and the Hotelling model of depletable resources (1931), has prevented hundreds if not thousands of energy economics students from being able to obtain a suitable insight into the logic of this subject. Even the commentators on CNN understand that the short run price of oil is determined by oil inventories (or oil stocks), and this price in turn influences the price of all energy materials. It seems to be true that the costs of finding and producing both crude oil and natural gas follow exponential curves, however in my lectures I attempt to give some idea of this topic with the simple equation C = αx /(β - x ), where C is the cost (in some monetary unit) of removing x percent of a deposit, and α and β are constants. If for example β was equal to 100, then C approaches infinity when the deposit approaches exhaustion. The key (but recondite) point here is that deposit pressure is the most important variable to consider when trying to explain the productivity of a deposit, and this pressure declines as oil is removed. Readers can substitute values of x in the equation in order to see what happens to C, however it is just as simple to look at a couple of derivatives: dC/dx = αβ/ (β - x)2 and d2C/dx2 = 2αβ/ (β - x)3. Both are positive, and so not only does cost increase as more of the deposit is removed, but this increase 'accelerates'. This might appear trivial, but unfortunately it isn't. In my new textbook I note that the technology is now available to dig oil wells faster, deeper, and cheaper than ever. The problem is the shortage of oil, which is something that certain people insist on not understanding. Thus, drilling is less expensive per foot, but more expensive per barrel of oil obtained. This is why the derivatives in the previous paragraph are positive. In my first energy economics textbook, I derived an equation that related the rate of growth of oil consumption with the rate of growth of reserves, and which displeased certain bystanders because of an approximation that was employed. I will now present a completely formal derivation in which no approximations are necessary, to include the one that I employed in my recent survey of natural gas (2007c). In the discussion directly below, the following notation is used: Q is reserves (a stock), while q is production (a flow). 'n' is the rate of growth of consumption, while 'g' is the rate of growth of reserves. T and 't' refer to time. Θ will be defined as the reserve-production ratio, or Q/q. But before turning to the integrals, I would like to present a simple numerical example. Suppose that reserves are 150 units, and output is 15 units per period. The reserve production ratio ( Θ = Q/q) is thus 10. Now let us assume that n = 0%, and g = 5% = (0.05), and see what happens to reserves. Q at the beginning of the next period is 150 - 15 + [150 x 0.05] = 142. 5. Both reserves and the reserve production ratio have fallen: the latter is now 142.5/15 = 9.5. In the same vein, we can start with a value of Θ = 40, and so with q = 15 (and thus Q = 600), and the same values for n and g, we get for the beginning of the next period Q = 600 - 15 + [600 x 0.05] = 615, and so as opposed to the earlier example, Θ has increased to 615/15 = 41. The next step is to generalize these results using some calculus. We start with the relationship for Q at time t = T, having commenced with a value of Q(0) at time t = 0.  Thus, for dΘ/dT > 0 we need Θ(g - n) > 1. For the values in the previous example, with n = 0 and g = 5%, for Θ to increase we must have Θ > 1/0.05 = 20. This is the same outcome as informally obtained in my earlier energy textbook. The next issue is short run pricing, and in line with my remarks in the previous section I will employ the stock-flow model that I developed for discussing the short term price of minerals such as copper, aluminium, tin and zinc, as well as oil, although the basic insight into pricing in this type of market was supplied by Professor Franklin Fisher of MIT in his work on the copper market. A conventional representation is found in Figure 1, and the accompanying discussion there clarifies that generally the diagram applies to entire sector and not a single firm.  Although you may not realize it, the almost nightly bad news about the oil price on TV infotainment suggests the formulation of an equation in which the change of price with respect to time is a function of the difference between AI and DI. This means that the relevant model for thinking about and discussing short-run pricing is a stock-flow model of the type in Figure 1, and not the flow model that you mastered in Economics 101. In the future AI and DI will be designated A and D, and at this point we can remember some advice of Professor Lipman Bers (1975), which is that the formulation of differential equations is what makes the world go round. Thus, the implicit form of the relevant equation for Figure 3 might be dp/dt = f(D - A) - or if the reader prefers a difference equation, Δ p/ Δ t = f(D - A). In either case what is being said is that the rate of change of price with respect to time is a function of the difference between desired and actual inventories. In Bangkok I told my students that the analysis up to this point had to be learned perfectly if they expected a passing grade, and I am happy to say that this was one occasion on which everyone got the message. Although not as important as the above, we can now write the equation for the rate of change of price with respect to time in a simple explicit form: dp/dt = - Δ(A - D), where Δ is a positive constant . (Accordingly, if A > D, price declines.) The following expression should be self explanatory if we take for the flow values s = s(p) and h = h(p). A0 is initial inventories and D* the desired inventories.  A differentiation of equation (5) with respect to 't' will then immediately yield d2p/dt2 = - Δ[ s(p) - h(p)] What about a solution for this simple differential equation when s(p) and h(p) are made explicit? My answer on the present occasion is to compare it with the differential equations behind the range tables you might encounter in ballistics - for instance those for the trajectory of projectiles from mortars and recoilless rifles. These relationships are well known to interested students of analytic geometry and physics, and have been well confirmed experimentally. I know of no such confirmation for the price-time relationship that would result from a solution of the last equation, and if I heard of one I would not believe it. 3. INTRODUCING OIL FUTURES As I pointed out in the preface to my new energy economics textbook, the best approach to the study of economics is to find out what you need, and if possible like, and then learn it perfectly. One of the things that committed students of energy economics need, and should make it their business to not just like but love, is a small amount of financial economics. Having written and taught from a book on financial economics (2001), I am under no illusion that this section will supply more than a few details about futures and options, however even so I expect my students to know materials in this and the following section perfectly, because learning them perfectly might make it possible to avoid the enormous amount of foolishness in circulation about the impact of derivatives (options + futures) and 'hedge funds' on the price of oil. I'm thinking of the Fox News star Bill O'Reilly, who for some reason has come to believe that the oil price is determined by "little guys" in Las Vegas manipulating derivatives, and not the supply and demand of physical oil. I start with a modification of an elementary example from my earlier textbook, and on this occasion I suggest that readers pay very close attention to the terminology. Knowing this terminology is crucial for impressing colleagues , friends, enemies and future employers! It is much more important than being familiar with a few equations. Millicent Koslowski is an undergraduate at the University of Pittsburgh, and a financial superstar in the making. She already has an innovative way of regarding the mechanics of her career: never buy when you should sell, and never sell when you should simply go home and take a shower! Most important, her radar is never turned off. She knows that what it takes to become a 'rocket scientist' is more than a perfect knowledge of the fundamentals of derivative markets and a sincere belief that more money is better than less money. The most important things are an iron concentration and something they repeatedly told her brother during his basic training in the army: stay alert stay alive. While eating breakfast one day her father, who works the night shift as a 'puddler' at a local steel mill, mentioned that a friend's Uncle Charlie phoned him from Genoa (Italy) and told him that all the tanker crews in the Gulf were planning to go on strike. That was enough to cause Millie to immediately leave the table, and before ten minutes had passed she discovered that this information had not reached the media. In other words, the means for financing her graduate studies at Harvard's Business School was about to make its appearance in her young life. She picked up the phone and called a mentor and former teacher, Condi Montana, who is a commodities broker. She informed that good woman that the time had arrived to buy some futures contracts for crude oil. This is sometimes called 'going long in paper barrels', as compared to the 'wet (i.e. physical) barrels' aboard the oil tankers that might soon be lying idle: physical oil is the underlying. "How many?" inquired Condi, and so Millie told her of the developing situation in the Gulf as explained by somebody's Uncle Charlie, and told her to use her judgement. Ms Montana immediately replied that she was going to buy 100,000 barrels for Millie, which meant 100 contracts, because each contract was for 1000 barrels, and since a maturity had to be specified, she was going to take thirty days: after thirty days, if the contract had not been exercised, it would expire. She also mentioned that she would be buying a few barrels for herself. Millie glanced at the latest edition of the Wall Street Chronicle, and noticed that the price of oil futures (with a maturity of 30 days) was $90/b, which meant that Ms Montana would be ordering about 90 million dollars worth of these assets for her friend. That struck Millie as a nice round number for someone living in one of the less distinguished residential districts of Pittsburgh. The procedure usually is that she would have been asked for a deposit - from 5 to 10 percent of the transaction, which is called margin - but today Condi Montana does not bother. She knows that even a rumour of this strike could send the oil price off the Richter Scale, and besides, she is too busy buying contracts for herself. She understands that this is the opportunity of a lifetime - the chance to change her name from Condi to Condo, in recognition of the kind of property she intends to purchase in quiet places like New Zealand and the south of Argentina - localities that would be without interest to the new crews of hijacked planes. Something that needs to be emphasized at this point is that Millie is buying futures and not forward contracts. True, a futures contract can be regarded as a forward when delivery is specified on the contract, but as compared to a forward, delivery does not have to take place. Instead, in a highly liquid futures market, a contract can be offset (or reversed) by just picking up the telephone and selling (or going short), if the opening transaction was buying (or going long). As a rough example the reader can think of the share (stock) market, where e.g. a position can be opened by calling your broker and buying, and an hour later your position can be closed by calling your broker and selling. Transactions in the futures markets for oil and oil products are easy to carry out because futures contracts are standard contracts, for a specific amount of a commodity, and should delivery take place because the holder of a long contract keeps the contract until the maturity (or expiry) date, which is 30 days in this example, then delivery takes place to only a few specific locations. (In the U.S. the stipulated delivery locations are New York Harbour or West Texas.) However as explained in my new textbook, it has become increasingly popular to settle contracts that are open at the expiry date with money instead of taking (or making) delivery. This is called 'cash settlement'. That afternoon, when Millie returned from the university, she switched on the television, and heard that tanker crews in the Gulf were indeed going on strike. Already the spot price (i.e. the price for immediate delivery) of physical oil on both the New York Mercantile Exchange (NYMEX), and Brent oil on the International Petroleum Exchange in London had jumped up several dollars. It was being quoted in both places as $93/b, but spokespersons for the oil companies are claiming that everything humanly possible was being done to reach an agreement with the tanker crews. This isn't easy because floating objects had been observed in Gulf waters, and when they questioned their employers they were told by one of these gentlemen that "every ship is capable of serving as a mine sweeper…once". That good person was only joking, but this was not the kind of humour that their employees appreciated. Millie called Condi again. The price of physical oil has gone up, she told her, and once she read a brilliant energy economics textbook by a great teacher who claimed that when the price of physical oil rises, it was very likely that the price of oil on futures contracts - i.e. paper oil - would also increase. Yes, Condi Montana told her. I know the book, and as usual that scholar was correct. The price of paper barrels is now 92 dollars, but there is an ugly rumour going around that the strike may be settled very soon. In addition, although this is not always the case, the fact that the futures price is below the price of physical oil is not a good sign at the present time. "Sell my contracts now," Millie said. "Dump them all". Everything considered it had been a nice ride, and although it had ended in 6 hours, she increased her 'wealth' (before taxes) by about $200,000 [ = 100,000 (92 - 90)] . Who said that there was no justice in this world, she found herself thinking. Something that should be noted here is that the price of futures and physicals do not have to be equal when the transaction was initiated, and the same was true when the position was closed, assuming that it was not closed on the expiry/maturity date of the futures. Now let's turn this delightful exercise around. An acquaintance calls Condi Montana from Rome and tells her that a large oilfield has just been discovered in Western Egypt next to existing oilfields in Libya. In other words, in order to get the oil to market hardly any new pipelines will have to be constructed. Supply up, price down, as Condi (and Millie) learned in Economics 101. Condi immediately went short (sold) a very large number of contracts for herself, and then called her former student Millicent Koslowski, and gave her the news. She suggested that Millie should also make a substantial investment - for instance, sell 100,000 barrels, or 100 contracts with maturities of e.g. 30 days. Where's the oil? How can you sell something that you don't have, which is what my students asked me the first time that I lectured on futures markets. The answer is that if you open a futures position by selling oil, you can close it at any time before the expiry date by simply buying the same amount. In this situation the ownership or location of physical oil is irrelevant. If, however, the contract is kept open until the closing of the exchange on the expiry date, then conventionally 100,000 barrels would have to be purchased from some source and delivered to a designated delivery point. Of course, it might be so that the contract could be cash settled, in which case if Millie held the contracts until the expiry date, she would have to pay the difference between the opening and closing prices if she lost on the transaction, or receive the difference if she gained. All this is fairly easy to understand, I hope. Condi Montana works now as a broker because she wants to avoid stress, but earlier she did proprietary trading in a financial institution, which means that she traded for them, and in return received a salary and - if things went well - a nice bonus. And things usually did go well, because as Gordon Gekko explained to Bud Fox in the film Wall Street, the key thing in that business was information, and the trading departments in the major investment banks had access to a very large amount. At the same time they employed people who knew how to interpret it. Mistakes and bad outcomes occasionally surface, but usually this requires a great deal of carelessness on the part of traders and analysts, and in addition laziness on the part of executives. So much for 'speculation', but what about hedging - i.e. some kind of insurance against unpleasant price movements up or down. (And observe: hedge funds are really speculative funds, and on average about one-tenth of these go out of business every year. I once sat through an inane lecture by a director of one of these, and I have no doubt at all that that gentlemen and his colleagues eventually had to find another line of work, although of course they may be back in business under another name somewhere else. After all, it didn't take the directors of Long Term Capital Management many months after a 3.5 billion dollar bailout before they were merrily practicing their trade in new offices.) In any event, suppose that two weeks ago you concluded that the oil price was going to rise to $100/b or above, and so you went down to the local 7-11 and bought a thousand barrels for $95/b. But now you are not so sure as you were then that the oil price is going to rise, and so you find yourself with an overwhelming urge to hedge your investment. How would you initiate this particular risk management exercise? One way is to call Condi Montana and tell her that you wanted to sell two futures contracts (= 2000 barrels). That way, if the price falls, what you lose on physical oil you gain on futures, because later you can close your futures position with a 'buy' at a lower price than the price at which you went short. Moreover, if it appears that certain so-called experts were right and the bottom is going to fall out of the oil market, you should find it easy to sell the small amount of physical oil that you are storing in the dining room of your home, while perhaps keeping your futures contracts, which become more valuable with every decrease in their price. Or, if things went the other way, reverse (i.e. offset) your short futures position by going long two contracts, and retain your physical oil. Maybe the price will break the $100/b barrier, and in the ensuing buying spree, you can make some serious money. Of course, if you can't make up your mind, you can always call Millie Koslowski, who will soon be in the fast lane on Wall Street. One more observation. You should never forget that Metallgesellschaft (MG) - the 14th largest industrial firm in Germany - lost 1.5 billion dollars in the futures and swaps markets in a few months. In addition, when a clean-up crew was brought in to put things right, they apparently made as many mistakes as the people who got MG into deep trouble. On occasions such as these it pays to remember a very important Russian adage: The wise man learns from the mistakes of others; the other kind of man must find out for himself! Recently there has been some talk in the financial world about commodity traders being nervous due to the expected impact of an increased OPEC output. The theory is that OPEC will increase its output by 500,000 b/d - which I don't believe will happen. If we look at a time series of the oil market for the last few years, what we see is that prices in the futures market for oil over a 28 week period (up to the middle of July) were almost always above the spot price. This is called contango! At the present time though that market is in backwardation, with the present (spot) price higher than quoted futures prices. Strangely enough, backwardation is the usual arrangement for the oil market. The explanation for the present backwardation is that inventories are considered too low (or DI > AI), and so in an effort to increase inventory levels the price of newly produced oil and existing stock is bid up, It also seems that talk is going around that backwardation has led to some undesirable speculation that both OPEC and the financial community want to dampen - or so they say. Professor Ferdinand E. Banks ferdinand.banks@telia.com December 6, 2007 The University of Uppsala, Uppsala Sweden The School of Engineering, Asian Institute of Technology, Bangkok Thailand |

| Home :: Archives :: Contact |

THURSDAY EDITION February 26th, 2026 © 2026 321energy.com |

|