|

WEDNESDAY EDITION December 17th, 2025 |

|

Home :: Archives :: Contact |

|

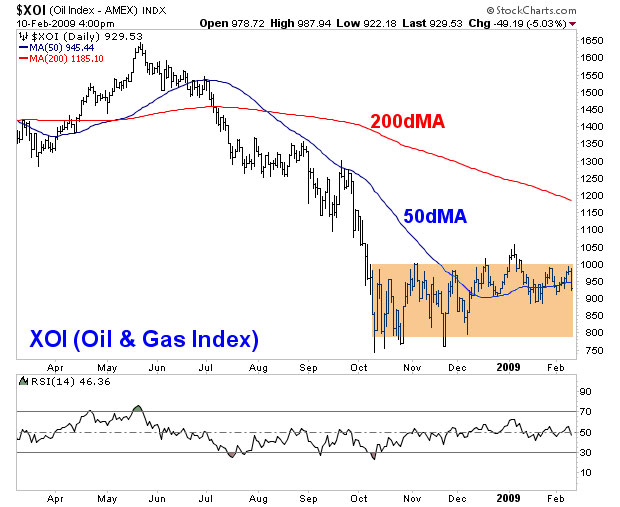

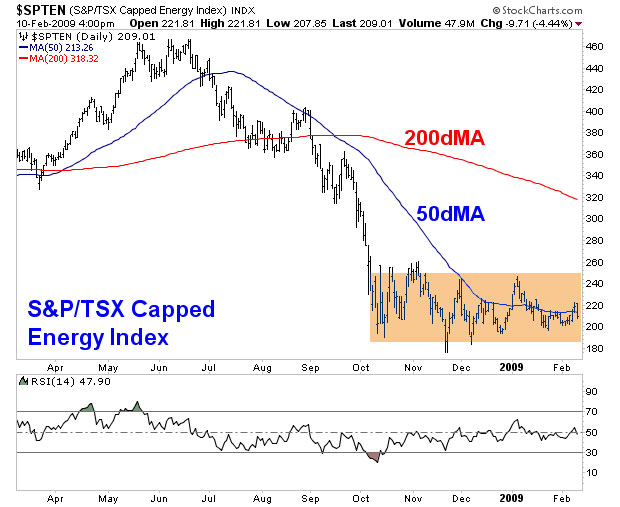

Energy Stocks Continue to Strengthen Their Case for a Relief RallyContributed by Olaf Sztaba NA-Marketletter Energy www.na-marketletter.com February 18th, 2009 In our previous Energy Comment, we underlined the importance of the bottoming action from mid-October to the present. During this period, the sector has been engaged in a major project of technical repair including:

Therefore, in the shorter term, the Energy sector should continue its repair work, hold above the November lows and stay near their 50-day moving averages. Given the mediocre economic situation, could a rally be far behind? In the last few weeks, the North American markets have had plenty of “incentives” to break down but each attempt was met by an equally swift riposte to the upside. This alone should indicate that many market participants have already cleaned out their portfolios and they are now looking for a signal to re-enter the market. The shift in market psychology could quickly trigger such buying and put oversold Energy stocks at the centre of a relief rally. The long-term perspective Despite the potential for a rebound, the long-term trend remains negative. The XOI and TTEN are below their falling 200-day moving averages; therefore, tight stop-loss levels must be applied to all positions. The Energy sector continues its repair work in building a base for a possible advance. The improved technicals should prompt the bulls to get a “shot” at a rally.   February 18th, 2009

February 18th, 2009Contributed by Olaf Sztaba Email: osztaba@na-marketletter.com Website: www.na-marketletter.com About NA-Marketletter |

| Home :: Archives :: Contact |

WEDNESDAY EDITION December 17th, 2025 © 2025 321energy.com |

|