|

THURSDAY EDITION January 8th, 2026 |

|

Home :: Archives :: Contact |

|

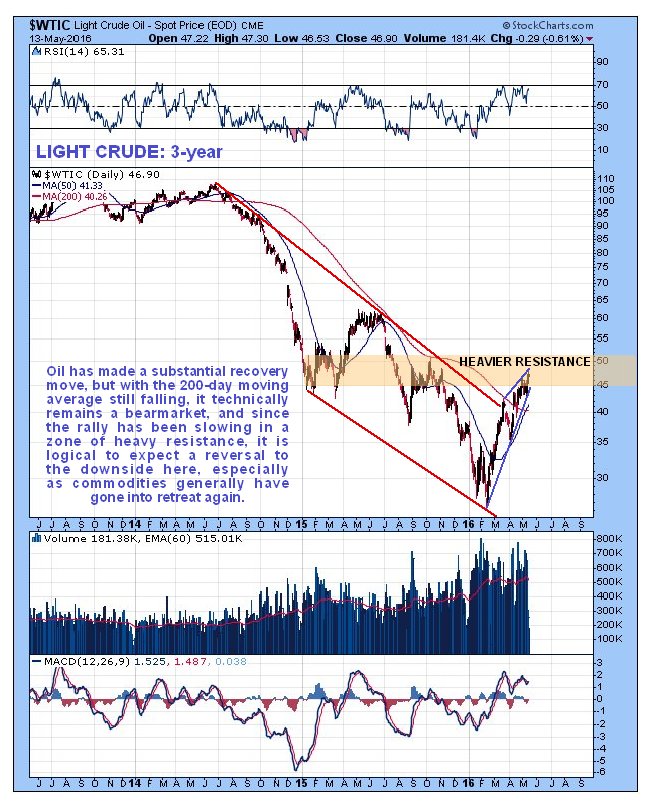

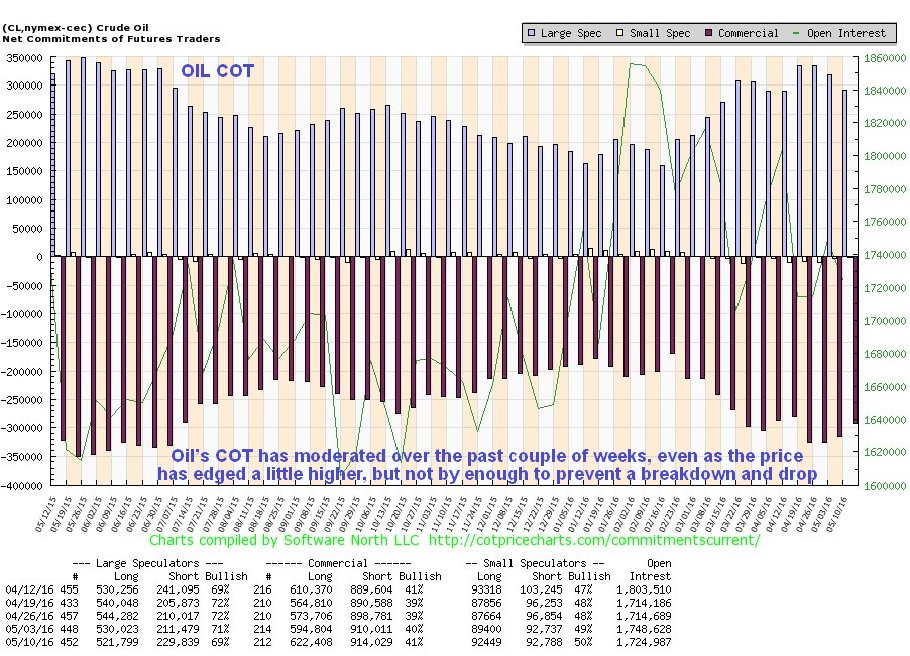

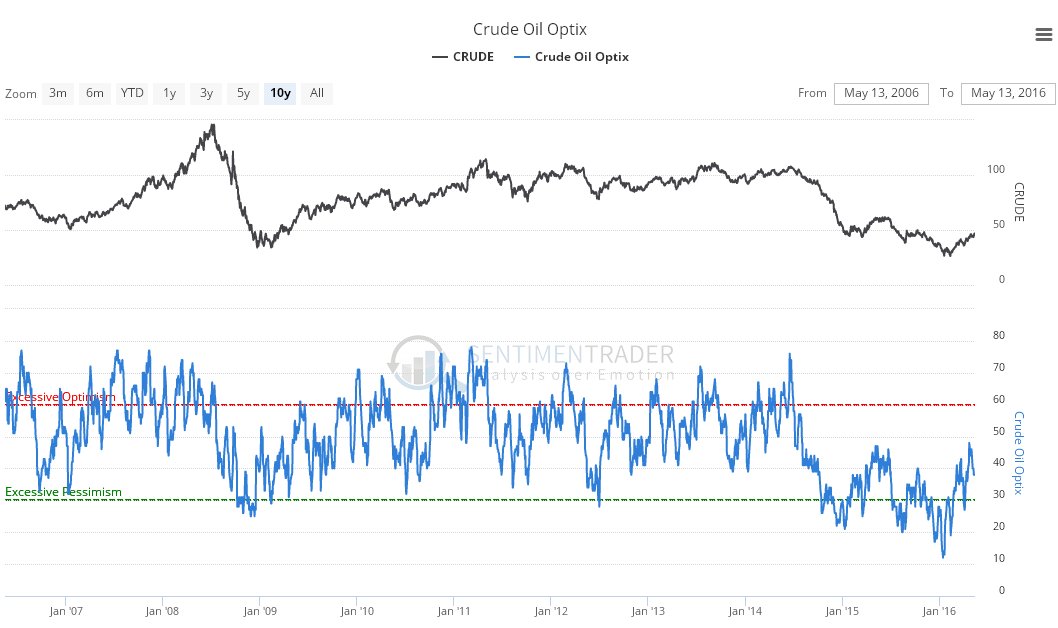

Oil Market UpdateClive Maund support@clivemaund.com May 20th, 2016 Oil did react back as predicted in the last update, dropping over $5, but then it turned around and rose to still higher levels, getting as high as about $47.50 last Thursday, as we can see on the 6-month chart for Light Crude below. However, although it has been making new 3-month highs, the advance has been losing force, with the new highs not confirmed by momentum (MACD) which has not been making new highs, and the uptrend contracting rapidly. A bearish Rising Wedge appears to be completing, and with the price well above a falling / flat 200-day moving average and in a zone of substantial resistance shown on the 3-year chart lower down the page, the chances of a reversal to the downside very soon are believed to be high.

Click on chart to popup a larger clearer version.

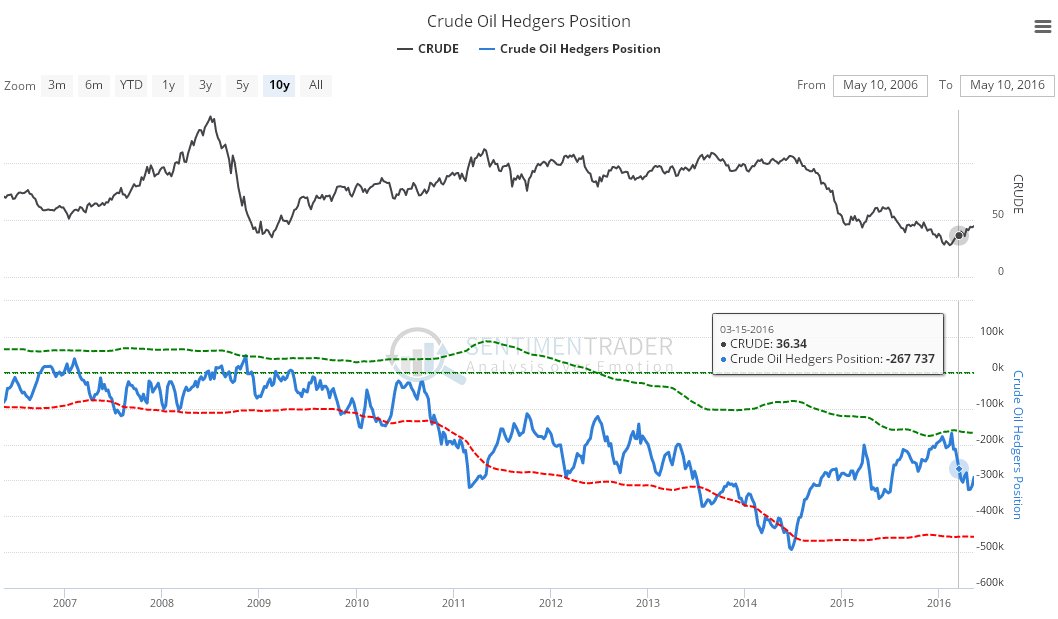

The Crude Oil Hedgers position has moved away from being bullish in February to a neutral reading now, and while not much of a guide, it does show that there is room for oil to drop now…

Click on chart to popup a larger clearer version. Chart courtesy of www.sentimentrader.com

Click on chart to popup a larger clearer version. Chart courtesy of www.sentimentrader.com

Clive Maund May 20th, 2016 support@clivemaund.com Clive Maund is an English technical analyst, holding a diploma from the Society of Technical Analysts, Cambridge and lives in The Lake District, Chile. Visit his subscription website at clivemaund.com .[You can subscribe here]. Clivemaund.com is dedicated to serious investors and traders in the precious metals and energy sectors. I offer my no nonsense, premium analysis to subscribers. Our project is 100% subscriber supported. We take no advertising or incentives from the companies we cover. If you are serious about making some real profits, this site is for you! Happy trading. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis. Copyright © 2003-2012 CliveMaund. All Rights Reserved. |

| Home :: Archives :: Contact |

THURSDAY EDITION January 8th, 2026 © 2026 321energy.com |

|