|

SATURDAY EDITION February 7th, 2026 |

|

Home :: Archives :: Contact |

|

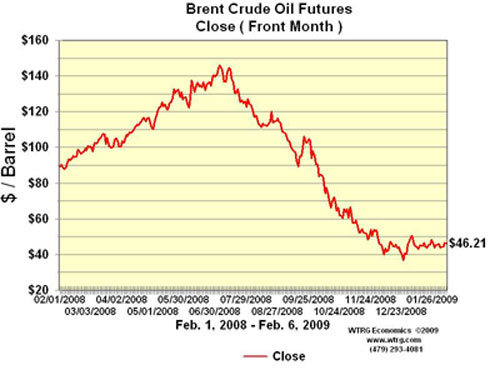

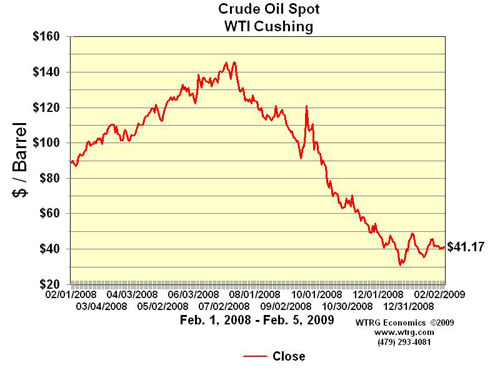

Oh Yes They Did!Rob Kirbyrkirby@kirbyanalytics.com February 14th, 2009 I’ve been trying to resolve what’s behind the recent inversion of the historic premium that West Texas Intermediate [WTI] Crude Oil has enjoyed versus Brent Crude? Historically, West Texas Intermediate Crude Oil trades at a premium price to Brent Crude Oil for quality as well as logistical reasons. In recent weeks and months – WTI has been trading at a deep discount to Brent Crude:

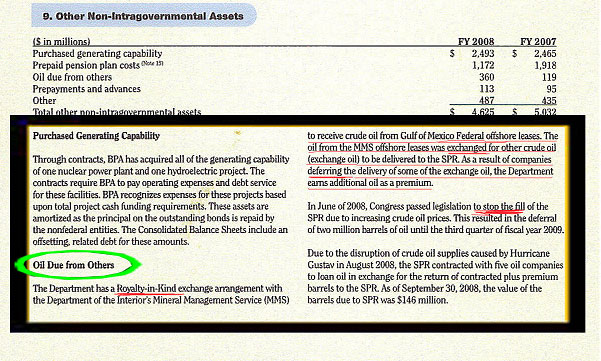

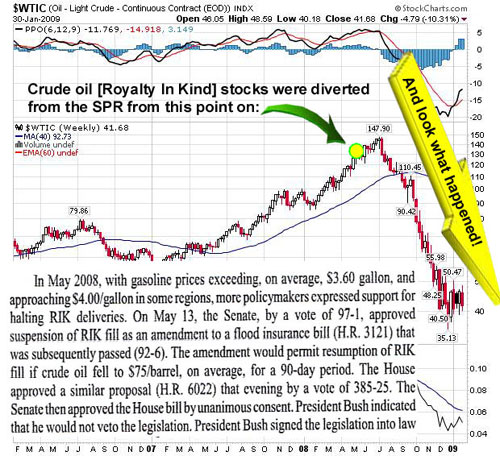

From an historical perspective, this price disparity pictured above is BACKWARDS. There is a reason: Recently, I shared with my subscribers some unusual machinations which are acknowledged to have occurred by the U.S. Dept. of Energy [DOE] back in May / June 2008 – from the DOE 2008 annual report:  The excerpt above illustrates that the DOE stopped filling the Strategic Petroleum Reserve [SPR] as of last June [2008] – an activity that had been underway – more or less continuously – since 1999. But the above excerpt says more than just that; it specifically states that,

“Oil from the MMS offshore leases has been exchanged for other crude oil” The “exchange” cited in the aforementioned quote above is also known as an “OIL SWAP.” Where Else Has the U.S. Government Done Swaps? There is proof that the U.S. Government is involved in Gold Swaps. From James Turk’s, The US Gold Reserve is Now in Play:

I have long suspected that the US Gold Reserve is being used by the gold cartel as a tool to help it try capping the gold price. See for example the April 23, 2001 press release by the Gold Anti-Trust Action Committee [ http://www.gata.org/node/4223 ] which refers to my then recently published article, “Behind Closed Doors”. The complete article is available at the following link: http://www.fgmr.com/clsddoor.htm The U.S. Treasury has only recently acknowledged that they have been involved in gold swaps. Not withstanding, for accounting purposes, they still claim to possess the SAME NUMBER OF PHYSICAL OUNCES. When gold is swapped or leased – it almost always physically leaves the vault and it is sold into the market – and it is replaced with an IOU. As evidenced above, crude oil has also been swapped – likely sweet crude, WTI - for less expensive sour crude. Under such a scenario – physical sweet crude left the SPR – creating a market glut of “premium sweet oil”. This set off an engineered over-supply chain reaction in the crude complex which depressed WTI’s price relative to Brent Crude. Because supply chain storage facilities are finite and were completely filled in the Texas / Cushing region – this also contributed to further price declines in the crude complex. This would also explain the phenomena of the world’s VLCC [very large crude carrier] Fleet being fully booked for storage purposes while the Baltic Dry Index is at or near record lows. Like the price trend of gold - the price trend of WTI crude is widely viewed as a benchmark for inflationary expectations in the economy. In the scenario described above, there would be NO APPRECIABLE ACCOUNTING CHANGE to the reported gross number of barrels in the Strategic Petroleum Reserve [SPR] – but only the “subtle acknowledgement” of the composition alluded to in the DOE’s annual report. We know that such actions were contemplated because of law makers’ unsuccessful attempt [in May of 2008] to pass a law making such actions legal and above board when H. R. 6067 failed to pass into law – because it was deemed to compromise long-term U.S. energy security:

H.R. 6067, The Invest in Energy Independence Act So we do know that efforts were made to do this “above board”. Heck, even then candidate for President Obama liked the idea,

ANALYSIS-Obama oil plan may weaken U.S. emergency stockpile From all of this evidence – and yes it is EVIDENCE – it is now highly likely that after failing to gain legal authority to utilize sweet crude in the SPR – DESPERATE authorities – who, no doubt will wrap themselves in the flag and claim they acted in the name of National Security – DID CONDUCT oil swaps. The timing of all these events lines up perfectly with the Waterfall decline in oil prices:  The smoking gun is the counter intuitive “lingering wide price discrepancy” with West Texas Intermediate trading at a big discount to Brent Crude Oil. More for subscribers. Subscribers to Kirbyanalytics.com are educating themselves; not only about the merits of ownership of gold and precious metals – but valuable know-how on the merits of different forms of ownership as well as tips and guidance on the acquisition of physical precious metal. Rob Kirby rkirby@kirbyanalytics.com February 14th, 2009 |

| Home :: Archives :: Contact |

SATURDAY EDITION February 7th, 2026 © 2026 321energy.com |

|