|

FRIDAY EDITION May 9th, 2025 |

|

Home :: Archives :: Contact |

|

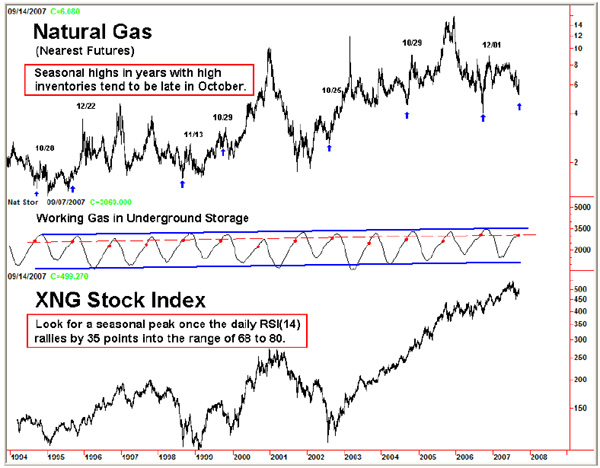

EnergiesChartWorks: published by Institutional Advisors Bob Hoye September 19, 2007 Technical observations of RossClark@shaw.ca Crude Oil The crude oil market continues to move ahead in the normal seasonal manner. Strength should be anticipated to last for another two to five weeks followed by a low in December-January. During years such as this when the oil stocks (as represented by the XOI) are in an uptrend the weekly RSI(14) has topped in the 70 +/- 5 range. The XOI currently sits at 1411 with an RSI reading of 57. It will take a weekly close of 1500 to generate an RSI of 65 or 1700 to generate an RSI of 75 by the end of the month. (For future reference, flat years show RSI tops around 64, while downtrending years have recovery highs with the RSI in the 50’s).  Natural Gas Even allowing for the upside bias of storage over the years the current natural gas inventories are at the upper end of the range (3069 Bcf) for this week of the year. In years with high inventories (1994, ’95, ’98, 99, ’02, ’04 & ’06) the seasonal rally has taken hold in the second half of September. But, unless the build-up in inventories slows significantly prices could easily top out by late in October. The stocks have come to life recently with increasing upside volume. The chart of the XNG can be used to monitor the rally. Ideally, the daily RSI(14) will move into the 68 to 80 range and provide an optimum selling opportunity.

BOB HOYE, INSTITUTIONAL ADVISORS September 19, 2007 EMAIL bhoye@institutionaladvisors.com WEBSITE www.institutionaladvisors.com

|

| Home :: Archives :: Contact |

FRIDAY EDITION May 9th, 2025 © 2025 321energy.com |

|