|

SATURDAY EDITION May 10th, 2025 |

|

Home :: Archives :: Contact |

|

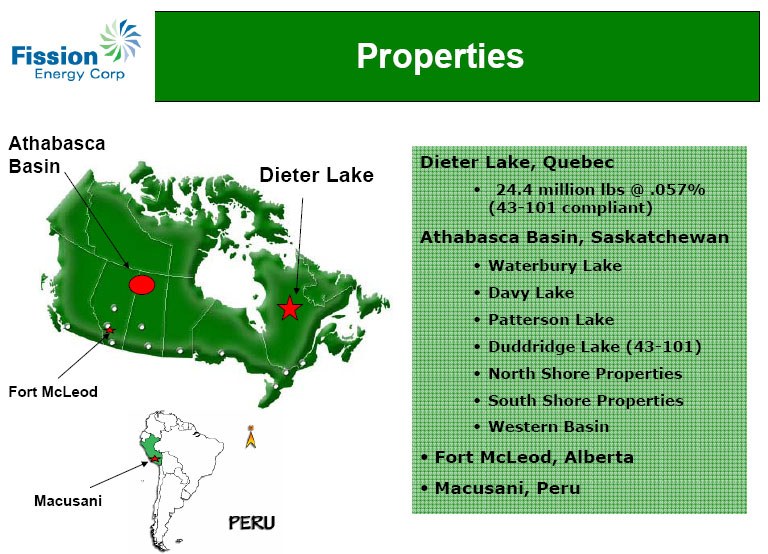

Fission Energy: Splitting from the HerdMichael S. (Mickey) Fulpmickey@mercenarygeologist.com www.mercenarygeologist.com February 4th, 2009 A Monday Morning Musing from Mickey the Mercenary Geologist There’s a big mama bear on the rampage, the likes of which has not been seen for nearly 80 years. But folks, you can count me as a perma-bull: I’m long…on something…someplace…somewhere…not just some of the time…all of the time. There are always ways to preserve or grow your capital, in the best of times and in the worst of times. Look at the overall market and economy as analogous to the theory of relativity: If everybody takes a 50% across the board loss in a bear market and you have as well, then you’ve broken even. The rich are still rich, the poor are still poor, and the middle class is still screwed. If you take a 30% hit, then you have split from the herd and are therefore richer. It’s the same in the junior resource sector: No matter how bad it gets, there are always a long plays out there in the bargain basement bin. For example, during our darkest days following September 11, 2001, you could have bought gold at $290 an ounce, silver at $4.50, Pelangio Mines for less than a dime, and Northern Dynasty Minerals for a quarter. Now that is a rich man’s portfolio, no? Splitting from the herd, i.e., adopting a contrarian philosophy can consistently produce big winners. But there’s a caveat that comes with any opportunity: You must do detailed due diligence. I own a uranium explorer that has split from its junior peers and wrote about it a few weeks ago, Hathor Exploration Ltd (HAT.V). Inseparably intertwined with the HAT story is another uranium explorer I like just as much, especially at its recent trading range of 15-35 cents. Fission Energy Corp (FIS.V) is a junior uranium explorer focused on the Athabasca Basin of northern Saskatchewan. The name aptly and appropriately defines this company. From Webster’s New World Collegiate Dictionary, 3rd edition: fission, “the splitting of an atomic nucleus resulting in the release of large amounts of energy.” Indeed, Fission Energy is splitting from the herd of junior uraniums and has been for the past 18 months:

And once again, folks, same as with the HAT, it’s about location, location, location. These companies are geographically conjoined at the hip in the heart of the northern Athabasca Basin uranium district: The +41,000 ha Waterbury Lake Property virtually surrounds AREVA-Denison’s Midwest Uranium ore deposit (41.6 million lbs probable reserve at 5.47% U3O8), their Midwest A (Mae Zone) discovery (5.5 million lbs measured and indicated resource at 0.57% U3O8 and 4.3 million lbs inferred at 21.2% U3O8), and the Josie Zone located between the two 43-101 qualified resources. The Midwest deposits are located within several hundred meters of Fission’s eastern, northeastern, and western claim boundaries and the structural trend continues on to the company’s northeast claim area. Fission drilled immediately east of the Midwest deposit in the late fall of 2007. Eight core holes totaling 2200 m were designed to test structures cross-cutting the Midwest electromagnetic conductor and magnetic contacts. Three of the eight holes drilled encountered significant radioactivity and/or alteration. Assay results included 0.10% U3O8 over 3.6 meters. That my friends, is a significant uranium intercept both in grade and thickness and encouraging to say the least. Perhaps more importantly, Hathor’s Midwest NE project uranium discovery, the Roughrider Zone, which several analysts have estimated contains a minimum of 30-40 million pounds grading about 3% U3O8, is sandwiched between two of Fission's claims. All of these mineralized zones appear to be on the same structural trend with coincident aeromagnetic, electromagnetic, gravity, and resistivity anomalies. The Roughrider Zone is very close to Fission’s eastern claim boundary. In fact, two of the HAT’s high grade uranium intercepts are within 30-40 meters of the boundary and two Hathor holes actually collared on Fission ground last March. This led to a brief squabble over claim boundaries that was quickly resolved by surveying and a ruling from the Saskatchewan Ministry of Energy and Resources. I am happy to report that the companies quickly kissed and made up and have since shared geophysical crews for a resistivity survey across their concessions. FIS.V completed a 19 hole, 8200 m drill program in the early spring and summer with 14 holes testing a WSW-trending structural zone trending from the Roughrider Zone and five testing other targets on the property. As with Hathor, they were hamstrung by drill locations on land. Nevertheless, the program was successful in identifying a large and intense, basement hosted, clay altered area, called the Discovery Bay Zone, which remains open to the west and southwest. Ten of the 14 holes encountered anomalous uranium and trace metals mineralization. Uranium deposits in the Athabasca Basin are commonly surrounded by clay alteration and Fission has located a large clay alteration envelope at Discovery Bay:

Strongly Altered Basement Pelite with Cross-Cutting Sulfide Vein. Based on current interpretation, Hathor geologists think the Roughrider Zone is localized at the intersection of a NE-trending structural envelope and the W-trending metamorphic foliation of basement rocks. Likewise, Fission geologists speculate that the Discovery Bay alteration zone is a subordinate trend related to the structural grain of the high grade basement gneisses and a parallel NE structural corridor. Perhaps the most compelling line of evidence for the prospective ground at Waterbury Lake comes from the integration of geophysical data. Coincident aeromagnetic, electromagnetic, resistivity, and gravity anomalies trend from the AREVA-Denison deposits and Hathor discovery directly onto Fission’s ground. The processed electromagnetic data is particularly striking. The following interpretation by FIS’s consulting geophysicist shows fault trends and uranium targets. Notice that the Roughrider Zone occurs at a flexure point where basement rocks change from a NE orientation to approximately E-W, the same trend of the Discovery Bay Zone:

Total Energy Envelope EM Conductors showing Interpreted Faults (thick black shears), Interpreted Uranium Targets (blue stars), and Fission Energy claims (light black lines) The Roughrider Zone is currently envisioned as an open pittable deposit with a mineralization 200+ meters deep. Even assuming very steep high walls, it is obvious that an open pit would severely encroach upon Fission’s mineral concession immediately to the west. If it is instead mined underground, there is a limited amount of land available for mine infrastructure both to the east and west. Either way, it seems probable that Fission holds strategic mineral ground for whoever might eventually develop Roughrider. With 42.0 million shares outstanding, $1.5 million in working capital, and carried by KEPCO for a minimum exploration expenditure of $4 million in 2009 and $4.5 million in 2010, Fission Energy is well positioned for the next couple of years of exploration at Waterbury Lake. It has recently traded in the 15-35c range and significantly off highs over $1.60 during the early days of Hathor’s adjacent uranium discovery. It has shown strength since the beginning of the year likely due to the general uptrend in the junior uranium market and anticipation of winter drilling in the Athabasca Basin. FIS.V has no warrants outstanding and only 3.3 million options to officers, directors, and consultants, significantly less than that permitted by the Venture Exchange. Insiders hold 12.4%, Sprott Asset Management 16%, and the KEPCO-led Waterbury Lake Consortium 2.3%. This gives a strong position of committed investors and a public stock float of about 29 million shares which should allow the company robust liquidity. Management has recently instituted cost-cutting measures including a reduction in overhead, discretionary expenses, deferral of other project exploration, and a 20% pay cut for all management. Although the 2009 budget is being finalized, my discussions with the company indicate the burn rate is currently $70,000 per month. With a management fee of 10% on the Waterbury Lake JV, Fission has sufficient working capital for more than two years without additional financing. I love it when corporate muckety-mucks are taking pay cuts in difficult financial times. It tells me they are looking at the company’s bottom line and its shareholders best interest rather than prioritizing fattening of their own pocketbooks. Folks, I’ve had skin in the Fission Energy game since acquiring shares in its split from Strathmore Minerals (STM.V) in July 2007 and I remain a loyal shareholder of STM. I have known most of the management and directors for a year and a half and spent many hours with them in both business and social settings discussing their companies, their projects, their plans, and their corporate philosophy. I like these guys both professionally and personally. In particular, I have spent hours with the President and COO of Fission, Ross McElroy, discussing the company’s prospects. Ross is the geological brain driving the company’s effort. He has worked a large part of his career in the Athabasca Basin, was part of the team that discovered the world’s best uranium deposit at MacArthur River, and has developed the drill targets for the upcoming winter program. Our sessions together have proven invaluable to my understanding of the geological and geophysical setting of the world’s premier uranium field, the eastern Athabasca Basin. Now you know that I evaluate stocks on fundamentals not technical analysis, but the one year charts give compelling evidence in support of my thesis that FIS.V splits from the herd. It has even split from HAT.V at times:

Note that the two stocks tracked one another from mid-January 2008 thru the discovery announcement, the brief and quickly resolved claim boundary dispute, and the early part of the summer when both commenced drilling. Then in mid July, macroeconomic woes and the summer doldrums devastated the junior resource market and Fission dramatically split from Hathor. It went south while Hathor went north. This trend continued until early September when the general market crash beat up all stocks and both lost significant market cap until late November. At that time and coincidentally with my November 24 musing, Hathor went strongly on the uptick again while Fission languished thru tax-loss season. To me that represented a buying opportunity in December and I did just that. I opine that the buying opportunity still exists. This is arguably the best area play in the junior resource sector that we’ve seen for some time: Claims surrounding two significant uranium resources held by majors and an on-trend junior discovery which could be a world class deposit. That old truth tool, the core drill, will tell the story this winter. I expect the upcoming drill program at Roughrider will make or break the deposit with three months of drilling on the ice. Fission should coattail nicely with the Hathor story. Be warned of significant early stage exploration risk here. Although FIS has drilled the same style and intensity of alteration and has the same geophysical signature as Roughrider, Midwest A, and Midwest, it has not found any significant uranium mineralization to the west at this time. But the geological and geophysical setting is not only permissive, it looks compelling to me. And remember that I am a shareholder and I am biased. Follow-up exploration drilling on the ice commenced on the Discovery Bay Zone at Waterbury Lake today. As mentioned before, the planned 2009 winter program is budgeted at $4 million with 6500 m of drilling, is planned and operated by Fission Energy geos, and is fully funded by its JV partner, the KEPCO-led Waterbury Lake Consortium. I’m expecting some good things to happen for Fission Energy this year. If Hathor defines a resource at Roughrider and is taken out by a major, Fission’s Waterbury Lake project will be a key ingredient for any company or consortium of companies to develop a mine. Fission Energy is a very bright glow-in-the-dark opportunity that has a good chance to split from the uranium herd with its market valuation in 2009. There you have it. Let’s split; maybe I’ll see you later at the bar and we can chew on this one some more.

Michael S. (Mickey) Fulp February 4th, 2009 mickey@mercenarygeologist.com www.mercenarygeologist.com Disclaimer: I am a shareholder of the company and was paid a fee for this report. I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in a technical report, commentary, this website, and other content constitutes or can be construed as investment advice or an offer or solicitation to buy or sell stock. Information is obtained from research of public documents and content available on the company’s website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. While the information is believed to be accurate and reliable, it is not guaranteed or implied to be so. The information may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. I accept no responsibility, or assume any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information. The information contained in a technical report, commentary, this website, and other content is subject to change without notice, may become outdated, and will not be updated. A technical report, commentary, this website, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, technical report, commentary, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, Mercenary Geologist.

|

| Home :: Archives :: Contact |

SATURDAY EDITION May 10th, 2025 © 2025 321energy.com |

|