|

TUESDAY EDITION April 16th, 2024 |

|

Home :: Archives :: Contact |

|

Navigating the New Economy, Lesson 1: "Worth its Weight in OIL"J.R. FibonacciSeptember 9th, 2005  If someone had to pick the top emerging market of the last few decades, I figure a decent candidate would be the computer industry. However, emerging markets typically are not leading markets. We may recall that

around 2000, there were some pretty big declines in the computer

industry. Other sectors followed, but were they really following the computer industry- or just following the leading markets more slowly than the computer industry

was?

What could those leading markets be? I know- you just read the subtitle- but let's think in terms of time. What happened in 1999- you know, right before 2000? An old hit song song by Prince got heavy rotation, but more importantly

for investors, a new major currency was introduced: the Euro. However, the BIG news was that

crude oil prices bottomed at $11 a barrel. Apparently, oil prices bottomed in

terms of other measures besides dollar price- price in Yen, price in British Pound, price in yellow brick Oz, and so on.

In the last ten years, 1999 was the year in which you could get the oil for the lowest cost, whatever one might have wanted to exchange for oil (with almost no exceptions). Let's

consider the longer sequence of events- as that can reveal the leaders

and the followers.Then, we'll explore what this sequence implies for

such

things as the alleged bull market in gold (in real terms or only

nominal dollar prices?), the future trends of US stock and real estate

markets and so on, but most importantly, for our everyday lives.

Yes, I

am an investment services provider, and I do welcome folks to consider

investing in my services, but only after you have a clearer

understanding of what I understand. I want you to invest with me not

because of a license or affiliation, but because you recognize that I

understand markets and thus can manage investments prudently.

Okay- most of the events in the sequence may be familiar. In the the 90s, a little tiny company called Microsoft got pretty big pretty fast, then some genius engineers there apparently couldn't predict what would happen after 100 cycles of a two-digit numeric field. Some say the Y2K "bug" was a metaphor for the short-sightedness of the modern marketplace. others say it was a devious plot- maybe just to sell a new operating system called Windows ME. I prefer to think of it as some of both. Either way, shares of Micrsosoft tripled in price in two years,

then lost most of that gain in a few months. Since then, those shares

have basically just been stabilizing in dollar price- less and less

fluctuation as time has passed.

So, if it was a plot, it worked well enough to attract desperate

computer users (and short-term investors), but then perhaps folks lost

confidence in acompany that allegedly didn't foresee the potential

problems of the Y2K "bug."

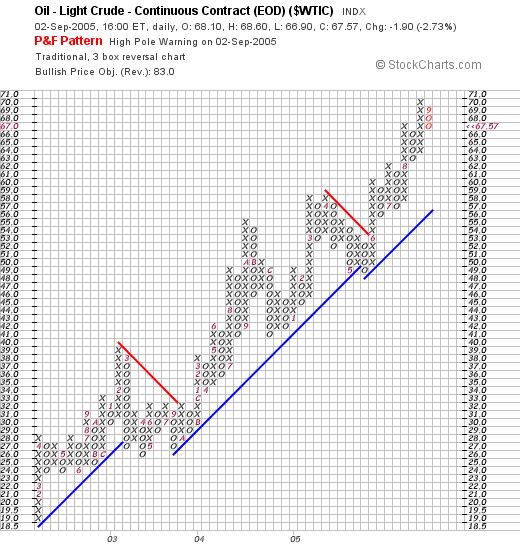

While the Y2K "bug" (program?) dominated the mainstream media and certainly generated a lot of investment in the high-tech sector in those last few years of the 90s, I mention it to bridge from something familiar to something less familiar to most folks: the NASDAQ stock exchange. NASDAQ is the high tech stock exchange in the US. By early Y2K, the cumulative price of the NASDAQ index had tripled in 1.25 years to about 5000 (in dollars). That means you could get about 500 barrels of crude oil for one share of everything in the NASDAQ- wildly approximating, but close enough for present purposes. Today, NASDAQ is priced at about 2000 (in dollars). From 5000 to 2000 is a drop of 60% or a factor of 3:5, leaving 2:5 as the remaining portion. Oil is priced at over 66 (in dollars), an

increase since 1999 of over 500% or a factor of about 6.5:1. In other words, today you

could get about 29 barrels of crude oil for one share of everything in

the NASDAQ.

The change is a factor of over 33:2. In other words, over 5 or 6 years, an

investment in oil has outperformed an investment in NASDAQ by more than

fifteen times. Again, I'm approximating here, but do you see the point?

The oil industry has apparently grown in importance faster than the computer

industry. I'm not saying oil has grown in

importance relative to computers by tenfold in the last several years,

but I'm saying only the exact multiple would be in question, not which was grew more in importance.

If we couldn't get cheap oil in abundance, how important would the internet be? Or, think of it this way- if you think computing is a leading market, how leading would it be during a black out (a power outage as modeled for January 1, 2000)? Sure, computing may have been the top-performer among emerging markets for a few decades, but if we modify the opening question to what is the single most important market in the world today- or the most important market in the last 100 years, would computing be on the short list? I suggest that the reason that e-bay has been so successful is not just the internet itself, but cheap transportation- which currently means cheap oil. So, let's be grateful for computing, but realize that your computer may have been designed on one continent, manufactured on another, assembled on a third, and shipped to you on a fourth. How many continents are there again? Computing is in position to eventually become a dominant market, but not without a certain infrastructure of international trade- which again currently means oil. So, back to the sequence, when the Euro was introduced and oil trends reversed in 1999- were those developments the result of the Y2K bug or the high tech sector collapse of early 2000? Of course not. But when oil trends reversed- and the entire infrastructure of international trade shivered- could that have been a factor in the 76% drop in the NASDAQ from 2000-2002? Sure, as I trust you would agree. It simply cost more to trade in computers. When it costs more to trade something, that can slow demand.

You might ask "weren't high tech stocks overpriced?" Obviously they were, or they wouldn't have dropped!

Every

top is overpriced and every bottom is undervalued- that is why there is

a long-term reversal, right? But WHY were they overpriced- why were investors so excessively

optimistic about the high tech sector? Did they ignore that something

like cheap oil might be a factor in the prominence of the computing

industry- and that cheap oil might be a temporary thing?

So- here's a quiz. Which is more fundamental to you: 10 barrels of oil

or a brand-new computer? Well, neither- but if I ask in gasoline

gallons, would you rather have 200 gallons of gasoline or one computer?

I'll make it easier- imagine there is no electrical power where you live.

The computer market is obviously a dependent market. So is fuel (a major use of oil- which is also used to make interesting things like plastic- right, like on your computer keyboard there). However, fuel is a more primary market than computers or even plastic. So, let's say you found some desperate geek that, even during a power failure, is willing to trade you your old computer for 200 gallons of gasoline. After all, maybe the geek has thousands of gallons of gasoline and really doesn't need that much, but would really like to put a laptop in their "electronic age museum." Alright, so now you have 200 gallons of gasoline. However, fuel markets are dependent on physical infrastructure like roads (and automobiles, automotive parts, etc) as well as political infrastructure (wars and so forth). You decide that you think the political scene is getting unstable, so you only want 100 gallons of gasoline, enough to get out of the region in one truckload like in the "Beverly Hillbillies." Needing 100 gallons and having 200 means you have 100 gallons to spare- because where you are going, you won't need any fuel- or it is really cheap and you can get much more there. So, here are your options- you can get a single ounce of gold or... enough food to feed your family very well for a week. Of course, you go for the gold, because you know the old saying "worth its weight in oil." Unfortunately, your family includes children AND old people. After you use about five gallons of fuel and these people start going CRAZY (and you are all in one vehicle, remember). Then, you realize that you are not really all that hungry for gold, but could go for some cheese (or whatever). Okay- I know my presentation is a bit silly, but the point is this: there are two primary "markets": food and shelter. EVERY other commodity is secondary- even fuel and yes even plastic computers. When there is a food shortage, people will even sell GASOLINE for food. I know it sounds crazy, but trust me on this- or just ask a four-year old if they will trade you their lunch for... a gallon of refined black gold. Unless the kid has at least two lunches (one to spare), there will be no trade, right?

Economy comes down to choosing an objective, then choosing some means

in pursuit of that objective. Usually, using one method will exclude

using others- insofar as you can go to one store or the other right

now, but not both at once. You might even go in sequence to two stores, but if you go by

car, you can still only use each gallon of gasoline once.

After that, you can't use it anymore. That scarcity is the root of economy. A choice about economy is called "economizing."

So, consumable goods (like gasoline and

food) are more likely to suddenly

become scarce than "recyclable" raw materials (yellow bricks, CD-Rs,

sturdy shipping boxes) or "durable goods" (a chair, a building, a

boat). Unless there is a hurricane or a war, the supply of durablesis relatively stable- compared to consumables.

During the winter in cold places, wood (for heating) may get

relatively scarce (valuable) compared to summer. That is predictable, right?

Perishable goods- which for practical purposes means fresh food- can

get scarce even faster than firewood. I can also go a whole summer without firewood.

Try that with food (then again, don't).

Now, and here is an important twist, everything that is not local has

to be transported to us. Consider this for a moment. That means if there is very little fuel available right now, people will do less "long-distance" business, staying more local. With less fuel, it would

be more difficult (costlier in time and other resources) to get firewood,

computers, or automobiles- not that autmobiles would be much good

without a supply of fuel- but you get the point, right?

If there is merely a shortage of fuel- not a total absence, then people might pay $6 a gallon obviously for it. Some folks may think "wow, that sure is a lot to pay." However, the people who paid that much apparently thought, "wow, I am sure glad this was only a shortage of fuel, because I got an entire gallon of gas- didn't have to abandon my vehicle and walk home- and only had to give up a few pieces of paper." Paper (or electronic currency) is always a "derivative" market. There is little inherent value in the coin or the bill or the paper check or the plastic card, but the contract or human agreement behind the currency is where it derives it's purchasing power. In

fact, the plastic card itself obviously has no intrinsic value because

after using it to make a purchase, you get to

keep the plastic card and maybe even use it again.

Eventually, it may look like just a little card of plastic; you will

probably throw it away (perhaps after happily cutting it into many

pieces).

This reminds me of my favorite scene in one of my favorite movies:

"The Gods Must Be Crazy." After getting a big handful of colorful paper

coupon "money" (as in dollars),

the hero drops them on the ground as he walks barefoot back towards his

tribe. Maybe he'll find some food on the way... and unless he could use

the colorful couponsto lure some small game, what good are they where

everything he values is abundant. He didn't even keep them as

collector's items!

Recognize that the value of things like a little plastic card (assuming long distance lines are working

and so on) is that you may be able USE it (as an "instrument" or tool) in pursuit of an economic objective. You might find someone who will give you

things that you value more than the electronic credits, but that s/he apparently values less- or they wouldn't exchange them with you for that, would they?!

Remember the example of trying to get a kid to give you their lunch for some smelly black liquid.

If you want their lunch enough, you would probably give up trying to

find the sufficient volume to entice the kid into a voluntary

exchange... and just try to steal it- whether openly or covertly.

So, credit money has no great inherent

value, but only derivative value. It has value as long as you cane use

it as a "financial instrument," a tool to get primary and secondary commodities- things you can actually use... to

eat or to heat and so on. Of course, you may also get services with

currency- or other contracts like gold futures, stock options, or

licenses and registrations.

All of those contracts also derive their value from what you can get with them in a voluntary exchange- including currency.

So, the yellow brick worshippers and plastic card devotees are all

dealing in financial instruments. Actually, gold is not ONLY a

financial instrument- and indeed it even has some nutritional value-

but on the spectrum of commodities, there is a reason they don't sell

it at most intersections with a traffic light, while gasoline is all over

urban areas (and grocery stores, etc). Gold, silver, and "pure" financial products

like currency contracts are primarily "instruments" for the storage of

value. We value these instruments because we expect

that other folks will later trade them for primary purchases like

commodities or

services. We expect to use the instrument to acquire a month of access

to a building (rent) or a bus ride- or the bus or building and

land.

Ah yes, barely a mention of real estate so far- let's address that. I

did mention that war and other political changes can effect the appeal

of a particular real estate contract. How about a hurricane or regional

economic shift?

Let's say that a region has a huge economic growth; could that effect real estate prices? Or how about this:

My favorite example of the predictability of real estate markets is not the huge drops in the 30s across the modern world or in the 90s in Japan and Russia, but this: the baby boom. Briefly, a bunch of soldiers stopped hanging out with each other exchanging gunfire and went home to their mates and soon there was a big surge in pregnancies. Even folks who were civilians celebrated the decrease in danger by intitiating more pregnancies. Well, to make a long story short, about twenty or so years later, there were a bunch of young folks ready to move out of their parent's homes- much more than there had been in previous years. Could that effect real estate prices? Most developers did not study demographics, but some who did realized that more twenty-somethings meant more demand in the housing sector. They were right- many young adults did indeed move out of their parents homes and start their own households- many more than in prior years. Why? You'e right- because there were just so many more of these young adults to move out than there were in prior years. The baby boom became the twenty-somethings boom. As many know, the "baby boom" was not just a few years. The real estate surge actually grew as these folks advanced in the job market and soon started purchasing homes in large numbers- again much more first-time homebuyers (and more total homebuyers) than in any prior year- for year after year after year. So, after a while, many folks noticed this change in real estate and thought- wow real estate is doing so well- look at these prices- doubled already since 1970! Most of these folks didn't predict the surge, they didn't understand the surge, and they didn't know when it was likely to end. They were speculators, and in the worst sense of the word- maybe a better word would be gamblers. So, they noticed the trend eventually and then starting following the trend. Some did very well... for a few years. However, the baby boom was followed by a

declining birth rate. Guess what that meant? Less first time-home

buyers from year to year is right!

Less twenty-somethings naturally resulted

in lower real estate prices. Some people called it an "S&L crisis"

(like it was fault of the Savings and Loan part of "the system" that

the birth rate had dropped after the baby boom). It wasn't any more of

a crisis than winter or dusk. It was a predictable contraction. Sure,

for gamblers who didn't understand what was happening, it seemed like a crisis, and they panicked far beyond the economic equilibrium.

In deed, real estate markets soon became cheap- temporarily- and thus

eventually started to expand again, because the folks who sold at the

bottom of the panic (not a crisis really)were discounting the real estate (ignoring it's inherent value).

It was a panic. Maybe

it was a crisis- maybe not. It definitely was a great opportunity to

get cheap real estate- all because of the end of the baby boom (and of

course the ignorance of speculators).

I tell you this market

forecasting stuff is simple. All you need to

know is what trends lead and what trends follow. Demographics like the

birth rate- in the absence of other factors- are predictable leaders.

Every market- food, fuel, housing, and even the job market will

predictably follow population trends, right? Markets may not all go in

the same direction- some will "benefit" and some will "suffer"-

but they will all move predictably as demographics change- again, in

the absence of other factors.

What kind of other factors? How about hurricanes? How about oil markets?  August

29, 2005: An oil rig that broke loose during Hurricane Katrina is

wedged under a bridge in Mobile, Alabama. The rig tore free of its

moorings as Hurricane Katrina lashed the Alabama coast before surging

downriver and smashing into the suspension bridge.(AFP/Stan Honda)

Now, I gave you the example of the baby boom and housing market to show you that it CAN be easy to forecast markets. If you only understand that, that is enough to understand that someone like myself, understanding what factors create and end trends, can help you to prosper- even in the midst of leading markets like oil smashing markets like housing. When we know the underlying ("fundamental") market conditions, we will not be surprised even when unpredictable events trigger an otherwise predictable "crisis," one that may have been decades

in the making. For instance, the introduction of the Euro didn't make

the dollar suddenly weaker or oil suddenly more oily. It simply exposed

the weakness already there in the dollar. Oil markets had been grossly discounted despite tremendous underlying strength- as we have since witnessed.

The introduction of the Euro exposed a pre-existing economic vulnerability like Hurricane Katrina exposed a pre-existing physical vulnerability (lots of people crammed along a coastline). The coastline was not fundamentally safe the week before the hurricane- but only temporarily safe. The temporary absence of a trigger that reveals old weakness is not the same as fundamental strength.

So, back to a more familiar example, we may

not be able to predict the temperature in a specific place at a

specific moment on a specific day, but we can reliably predict that

certain seasons will be warmer or cooler. Eventually, whether in

December or January, it will very likely freeze where I now live. There

is a fundamental potential for freezing temperatures here- and if it

doesn't freeze for 20 months, that doesn't mean it won't the next

winter month. The absence of freezing temperatures in the middle of a

given winter day doesn't equate to a climate change. A freeze is likely

here- even if an entire week in winter is above freezing.

Of course there will opccasionally be unusually warm days some winters, but even that is predictable- there is some warning even if only a few weeks or days. That is why understanding leading indicators and monitoring them is so essential to optimal investment results.

Back

to investments, let's consider oil. Oil markets are led by more than

demographics, though all of the following may also be quite familiar.

Remember

the earlier reference to the Beverly Hillbillies? "Black gold" was a term I

learned from that show. The hillbillies came from Texas- and the "bubbling crude"

had made them rich. (Yes, this was before the Beverly Arabs.)

There was also the TV show Dallas about oil executives as I recall.

There was even a football team in Houston called the "oilers." The oil thing was a

pretty big deal.

In fact, a relatively minor country called the United States emerged to superpower status in the early twentieth century because it contained Texas and Texas was the center of the oil industry and lots of people a long way from Texas wanted oil. Did you get that? People all over the world increasingly valued this new commodity called oil. Texas was the center of the oil industry. The US, by drilling and refining this black gold and then selling it to people who really valued it- more than a load of wood or ounce of gold or paper currencies, became a superpower. A barrel of oil sold for $2 in 1970 (not a gallon of fuel, but a barrel of oil). It sold for less than that previously- however, the US sold a LOT of it, so total sales brought the US wealth like it had never before experienced. Since the US was about the only place to buy oil, everyone else had to convert their currency (or wood or gold, etc) to the US currency, dollars, in order to get oil. So, even though a certain business operation called the Federal Reserve Bank had inflated the dollar dramatically from 1913 to 1970 (especially 1934), this "derivatives contract" called "dollar" was still being exchanged for commodities of real value- even though the "Fed" was creating more at the stroke of a keyboard (they didn't even have to roll the presses). By the way, a barrel of oil costs $70 now. Yes, that is a ratio of 35:1 (1:35). But the point is that even AFTER 1934, people were still using dollars all over the world. There was a HUGE underlying weakness in the fundamentals of the dollar- which was soon revealed. So, in 1971, people were actually giving up half a barrel of

perfectly good crude oil for one of these dollar contracts! Since the US had the oil, everyone wanted the US currency so they

could use it as an instrument to buy the US oil. (Otherwise, they would have to invade Texas to get

oil and Texans have quite a reputation.)

The flood of other currencies chasing US oil markets meant that

the dollar was worth quite a bit while the US was a net exporter of

oil. The oil, not the derivative currency contract, was the underlying

strength.

However, when oil consumption rates in the US exceeded oil

production rates, the US became a net importer. Guess what happened?

Yes, of course the dollar lost most of its (remaining) value in the following decade, but the point is that this had all been forecast far in advance by folks who knew what created trends and foresaw the intersection of two trendlines (domestic consumption and domestic production). Did you get THAT? Here it is in a different order. Some people knew oil was important- including some in Texas. They saw that American purchasers were increasing their consumption of oil faster than Texans were increasing their production of oil- much as the Texans were trying I am sure. The obvious resolution of that- given that many other places were discovering oil deposits and building refineries- was that the US would eventually import oil- after decades of being THE oil monopoly- well almost. Indeed, many of those offshore (foreign) oil businesses were owned and operated by

Texans. The employees of both the foreign and domestic oil operations were trained in Texans. Much of the equipment was built

in Texas. The Beverly Hillbillies, however, was filmed in Hollywood-

but virtually every other facet of growth related to oil markets

centered in a certain part of the USA known as Texas.

So, while Texas still did rather well as the continuing center of the global oil industry, there was not so much foreign interest in the dollar- because the US wasn't exporting much anymore. Indeed, some of these other countries strangely did not accept US dollars for oil- or they did not HAVE TO at least- because they had their own currencies. The dollar's monopoly on the global oil market shifted from an economic imperative to a political challenge. Many of these foreignors stopped selling their currencies for dollars- how dare they!? Of course, Texans wouldn't sell the foreignors oil because Americans were willing to pay more than foreignors- so much more that they imported oil from the foreign sources. This was easy because after decades of having a near monopoly on the global oil industry, Americans in general were pretty wealthy- for a while. American consumers changed the US from the major Oil Producing and Exporting Country to the biggest importer of oil in the world- in just a few years. That single factor, the excess consumption of oil by Americans, may be all that happened to the dollar in the 70s. Sure, there had been underlying weakening since 1913, but here was a predictable trigger. Of course, Nixon was a convenient guy to blame for the recession of the early 70s and the "demonetization" of the Federal Reserve's "US Dollar" Note (Promissory Credit), but it actually wasn't his complicity with his campaign aide (see "Watergate") that made the difference in the economy. Many Americans were just mad that things had changed and upset that they had been surprised- so why not try a new "figurehead" (leader?)? Again, the US's shift from net exporter to net importer of oil may have been a factor. The folks who forecast WHEN the change would occur also forecast the effects- the devaluation (hyper-inflation) of the dollar, the stock market contraction (crash) of the early 70s, and even the predictable political reactions of the Americans; they blamed the very folks who were allowing them to consume more oil than they produced: the NEW Oil Producing and Exporting Countries ("OPEC"). The pilot episodes of the "Beverly Arabs" were not well received by American audiences. Okay- I am just joking, but the BELIEFS of most Americans are just as ludicrous to me as the idea of such a show might be to you. The Americans found some Arabs to blame, in particular one in Iran, then propagandized themselves with mainstream media including the school system. Did they admit their complicity in the decline of the dollar? Why would they? Did they reduce their consumption of oil? Again, why would they- they were rich from exporting it for so long! After decades of being the oil dynasty of the early twentieth century, they were drunk- and not just a few presidential Texans. Ah, but now let's jump from 1971 to 1999. A barrel of oil has gone from $2 to $11 (and had actually been much higher). That is, the purchasing power of a single dollar contract has gone from half a barrel of oil down to one tenth of a barrel- a factor of more than 1:5 (5:1). Now, since 1999, oil production rates in the entire world- not just one country- are growing less and less each year. There is less exploration, less new drilling rigs, less new refineries, less training of new oil industry professionals and so on and on. Even Texans are finally starting to get mad; their pet industry is losing "steam." Unlike the 1970s, there are no neighbors to bail out the consumers to allow them to continue expanding consumption. There is no OPEP (Oil Producing and Exporting Planets) to blame. So, a funny thing happens. Just as some folks had predicted, oil prices sharply reverse trend and start to rise (that was 1999). In few years, the dollar contract has dropped in relative purchasing power to a barrel of oil by a factor of more than 5:1 (from $11 to over $66). Again, from 1971 to 1999, there was a similar multiplication, but that was thiry years and this was six- one fifth the time. Of course, the $11 figure was a low, not a high, but here's the twist. In the 1970s, did a barrel of oil rise in yen, pounds, yellow brick OZs, and so on? Remember, that was only a single regional shift from exporter to importer. Mostly what happened in the 1970s is the dollar lost value. To get an Oz of yellow brick in 1979, for instance you would need more than ten times as many dollar contracts as in 1971. THAT was a high for gold and it has dropped dramatically since then. More importantly, to get ANYTHING in the 1970s, you would need more dollar contracts than you would have in the previous year. The domestic oil market predictably led the international dollar market and everything else was predictably following the first follower. Again, if you price a barrel of oil in international financial instruments, like gold

or major currencies besides the dollar, you see that what happened in

the 70s was largely

only a national crisis. Yes, that national crisis had

predictable infleunce on other countries because the US was a

"superpower" and a major trading partner with so many countries. Oil

prices in other places were effected by the shortage in the US.

So consider that today, if you price oil in terms of gold, yen, euro, and so on, oil is still rising in purchasing power dramatically. This is not just a national fluctuation- that is, reflecting merely a drop in the dollar- but a very major change in international oil markets. Lately, oil markets are really experiencing a major shift in supply and demand- according to international prices. And, once again, the dollar contract is losing purchasing power as it is losing prominence. The dollar was still the unchallenged premier currency in the world...until 1999. But the dollar's recent all-time lows are not about the competition from the Euro, folks. That is just the immediate trigger. It's about oil. The primary issue

is no longer simply that Americans use much more oil than they produce. This shortage is world-wide. Because of the

extremism of the American addiction/dependency on oil, the dollar is

just doing the worst of any major currency- and of course it had the

most "market share" to lose!

So, let's look at the value of the dollar from 2000-2002 in terms

of

multiple comparisons. In terms of oil, the dollar lost a LOT of value (about an 80% relative loss).

In terms of EVERYTHING ELSE, the dollar still didn't do very well, but nearly not as bad as compared to oil.

That's the US Dollar Index below.

This index relates the dollar to multiple major currencies.

The dollar performed about the same from 2002-2004 against all

other major currencies. Compared to other financial standards like

yellow

brick OZs, US real estate, and US stocks, the dollar still followed a

pretty

consistent pattern in all those markets- down about 1/3. That's

right: from 120 to 80 like chart says.

Gold went from about $250 to about $450- almost a 1:2 ratio. The dollar

exchange rate (price) for British Pounds went from near a 1:1 ratio to

nearly 1:2. The price of the 500 biggest US stock shares went from

below 800 to over 1200 (a 2:3 ratio). The NASDAQ went from 1200 to over

2000 (a 3:5 ratio- between 1:2 and 2:3). US Real Estate saw a similar

rise in price.

Okay, so when oil gets much more expensive in terms of only the dollar, but nothing else, that is just a national crisis in that national currency (the 1970s). When oil is rising in value compared to everything, that is quite different (1999-current). Now, from 2002-2004, if you look at all the dollar prices rising consistently across different markets like gold, stocks, real estate, yen, euros, etc..., what does that tell you? There is no "bull market" in any of those things! They are all moving pretty much in tandem with each other and at the similar rates- oil is the one that stands out as the obvious leader. For instance, if you price gold in yen, euros, US real estate, US stocks, and so on, it is pretty flat for the last few years. ONLY if it is priced it in dollars, however, is gold "outperforming." Again, there is no bull market in gold- or only a very weak one- on par with the recent "rallies" in NASDAQ or US real estate. Those "rallies" may have been primarily fluctuations in the dollar; that's all. Relative to oil, gold is indeed far underperforming. Now, I start with yellow brick Oz because so many folks seem so hypnotized by the mystique of gold, but remember my prior comments- would you give it away for food? Would you rather have bought gold futures or oil futures several years ago? Do we realize that over the last 25 years, gold has underperformed the dollar (and thus most other markets)? What does the chart below indicate: that in the last few years gold is doing well... or only that it is doing well relative to the dollar?  Now, let's review a few other markets for comparison. Again, I am focusing on 2002-2004 for the moment. If you price yen in gold, euros, US real estate or US stocks, the yen was rather flat. It was flat relative to pricing yen in dollars (outperforming) or oil (underperforming). If you price euros in gold, yen, US real estate or US stocks, the euro was rather flat. It was flat relative to pricing euro in dollars (outperfoming) or oil (underperforming). If you price US real estate in yen, gold, euros, or US stocks, the US real estate market was rather flat. It was flat relative to pricing it in dollars (outperforming) or oil (underperforming). If you price US stocks in US real estate, yen, gold, or euros, the US stock market was rather flat. It was flat relative to pricing it in dollars (outperforming) or oil (underperforming). Don't you notice a pattern here? There is no major "bull" market (boom) in gold, euro, yen, US real estate or stocks, but ONLY in oil. Further,

the dollar in contrast was in a severe "bear market" from 2002-2004.

The "quiet" decline of the dollar is why people who don't understand markets are STILL optimistic about gold, real estate, stocks and so on- because they saw dollar prices go up in for a few years. Indeed, as the global economy shift has left many of them extremely desperate, this excessive speculative optimism is predictable! (Some contrarians call this phenomenon "denial.")

So, dollar prices going up just means those markets are outperforming the dollar. This is called a nominal gain- for which taxes are often paid. This means that, after taxes, those investors may have even less purchasing power than a few years ago. That is a real loss (in terms of purchasing power or value).

This is of course good to know, even if it is not what you were hoping

to read. Once we accept what is happening, we can understand it and

then honor it by redeeming our practices and thus perhaps even profit

from the continuing shift.

Speaking of continuing shift, frankly, oil markets

have been booming for a century. Similarly, the dollar contract has

been crashing in purchasing power for 92 years with only relatively

minor exceptions.

These two items are not very complicated. These trends are even simpler actually than any temporary baby boom in real estate. However, there is a problem with idea of "the eternal oil boom" (and the eternal dollar decline). Oil is such a fundamental commodity in today's global marketplace that the end of cheap/abundant oil could bring an end to other trends. You cannot just pass a law to make more. You cannot buy some paper and ink (petroleum-based of course) to make more. Those DBA "the Fed" cannot stroke their keyboards (plastic derived from oil of course) and make a new deposit... of oil. The economic expansion of the last FEW CENTURIES may be reversing and contracting. Again, tops are always overpriced, right? The bubble is always over-expanded- or it wouldn't contract, no? The boom in expansive oil markets appears to be ending. The Texans are so mad they are calling for a ban on reruns of the TV shows that reminds them of the good old days, even "The Beverly Hillbillies." (As one of my nephews used to say: "that was a joke...?") Are you getting THIS? The expansion of the global marketplace depends on cheap oil. Cheap oil ENDED in 1999. There will be a MAJOR contraction- and it already started effecting the dollar. Other markets will follow. Again the NASDAQ already fell 76% from 2000- 2002 (then, in international terms, had a small reversal). That slow small rally leaves a lot of room left for it to fall. The broader US stock market, the S&P 500, already fell 46% (then, in international terms, was rather flat). Like NASDAQ and so many other markets, the S & P 500 also has quite a bit of downside potential before much strength there is expected by reliable forecasters.  This decline in US stocks actually resulted in a small rally (in

international terms) in the US real estate sector (the blue line in the above chart). Many fleeing stock

market investors SPECULATED that US Real Estate was safe- just as astute forecasters predicted. Because so

many acted AS IF Real Estate was safe, they have been relatively accurate- so

far.

Is Hurricane Katrina the trigger for the exposure of an underlying

fundamental weakness in US Real Estate markets? If not, another trigger

will come. If there is no fundamental economic

strength in the US today, US real estate must decline eventually.

Weakness in US stocks or the dollar which leads to a "flight to safety" is not the same as strength in real estate. Real Estate markets are nowhere near as strong as oil markets.

Think about it. Oil is the leader. US stocks followed. The dollar followed them. Real

Estate will follow next. Every move is predictable- like a wave coming

to shore through the deep markets to the shallow markets.

So, it may not be long before gamblers/speculators in US real estate are suddenly exposed to the order that is evident in all this. They may not understand the domino effect, but they will witness the next domino.

The recent followers of the real estate boom is just like

those who followed the trends near the end of the baby boom housing

surge. They were right (by accident) for a few years, then not so right.

Actually, though, there is one big difference. This latest boom is a desperation

boom as banks were aggresively refinancing in an effort to extend the

period before the flood of foreclosures accelerates. (The foreclosure

rate increased since 1999... predictably!)

Where is the underlying fundamental economic shift that dropped interest rates? What led banks to give interest-only

loans and drop down payments rates TO ZERO? What led homeowners to go

for all that- a fundamental shift in housing technology and prosperity-

or DIFFICULTY paying their existing bills?!

Sure,

excessive optimism and desperation look a lot alike, but that is much

different from a fundamental shift like demographics. The latest real

estate binge has not just been a dollar fluctuation, and not

even just a predictable response to a global oil shortage and reduction

of consumption. Another predictable factor has been how the masses would respond to each stage of the wave- including desperation adjustments.

This is like going from the blown down straw house to the log house in a hurricane (or "The Three Little Pigs). The log house MAY be safe, but that depends on the hurricane.

Many

people may not be emotionally prepared yet to accept the extent of the

shift underway. They will react predictably- swarming like a snowball

growing on the way down a hill. Recently, they refinanced themselves

into an even more unstable position. When a trigger exposes that

fundamental instability, the band-aids on the dam will fly along a jet

of liquidity.

So, how can I possibly suggest that oil markets can effect real

estate markets? First, let's say you commute from your suburban real

estate location to work. Let's imagine that today it costs

you three times as much as it did a year ago. Could that effect real

estate

prices?

What

if people simply have less money?! What if the local economy contracts-

everywhere at once? What if the stock markets, computer industry, gold

markets, and

even oil markets all contract?

That's right- eventually even oil will be overpriced as it gets so expensive that people do something really radical- decrease their use. Then the Texans and even the Arabs may reduce their consumption of everything. Could that effect real estate values in Texas and Arabia? Now, you are getting this, right? Oil markets do not just drive the dollar, but every international financial market. Of course, when there is a change of this magnitude, there are ALWAYS political scapegoatings and crisis. Remember the little national fuel thing in the 1970s was MINOR- compared to today when there is no OPEP to bail out the earthlings. So, as odd as this may sound, the dollar contract- because it is a contract that people ASSOCIATE with value- may RISE in purchasing power dramatically (at least temporarily). I'm not going to try to explain this one now in any detail, but consider this: if you had $1,000 or $10,000, would that effect how much you valued each individual one? Well, just like expanding global trade relies on cheap oil, the inflationary expansion of the US dollar contract (or expansionary inflation) is derived from or dependent on an expanding economy (more or less). When people have less income, they value their savings more. They might even spend less on... real estate. Anyway, I trust that with the string of clear examples I gave, you will take my word for it when I say that this is not only possible for the dollar to increase in value, but predictable. It just may not be as easy to explain as the baby boom housing surge or traveling with children who are hungry, but not for yellow bricks. But I think I said it pretty clearly. If you had less income, wouldn't you value each dollar of that income more? Just like you would value a gallon of gasoline if you knew you wouldn't have any more for a week? So, when the entire international trading apparatus is contracting as oil prices peak, what does that mean for consumers? It means you will be doing less international trade and getting more local products and services, plus paying more for shipping and all transportation (and thus traveling less). (Don't think you do any international trade? Where was your computer built- not bought, but built?) Will all this disrupt the internet? Maybe, but more likely, the internet will just get more local- like everything else. However, there is also a great opportunity from these major transitions- because most people will not predict them but indeed will respond quite predictably as the shift accelerates. In other words, they will panic. Again, the NASDAQ fell 76% in a few years. The dollar fell in a few years by 1/3- I know, you didn't notice, but you will. You didn't notice because most domestic prices (products/services) did not change- or not in terms of dollars. In international terms, prices in the US fell for almost everything- not just computers and, yes, even real estate. If you weren't selling internationally, you didn't notice. But the fact remains. And like the Texans not long ago, the people in general will not be happy about this. They may not understand, but they will change their behavior. If you are in a position to sustainably provide primary necessities (like nourishing food, economical shelter, or even primary services like efficient transportation), the contraction in international trade may be very good for your business. Plus, as I said, there will be more panics. Panics means staggering changes in trends. Since so many of these are predictable- not just what, but when- there is a lot of money to be made from these changes in trend. I can help you position yourself (or your assets) in front of the emerging trends- catching the surge of each wave of dominoes, one after another. Realizing the extreme hazard of speculatively following trends is a first step.

If you can FEEL the significance of the opportunity in our midst, I

have done well in my presentation. If you have assets to invest, you may

choose to do so with someone who understands not only the fact that trends form and change, but also why, how and even precisely when. If you invest in a partnership or collaboration with such a person- such as myself- you will do well, too.

Sure, some of the shifts will be easy enough to trade that you can do pretty well yourself. However, if you recognize that some people are more dedicated and diligent in their forecasting and execution, I trust that you will see the value of at least diversifying into my services (and then do so). I

will not just be trading the biggest, easist trend to predict, but trading the

entire sequence of dominoes- compounding the gains with each domino.

This will not only keep you from finding yourself at the end of a trend

and buried in a panic, but doing very, very well. I

look forward to assisting you, if you see fit, in sharing the benefit of my

understanding of economy, markets, instruments, and trends.

J.R. Fibonacci

ŠThe Anonymous Protected Equity Exchange LLC |

| Home :: Archives :: Contact |

TUESDAY EDITION April 16th, 2024 © 2024 321energy.com |

|