|

MONDAY EDITION February 2nd, 2026 |

|

Home :: Archives :: Contact |

|

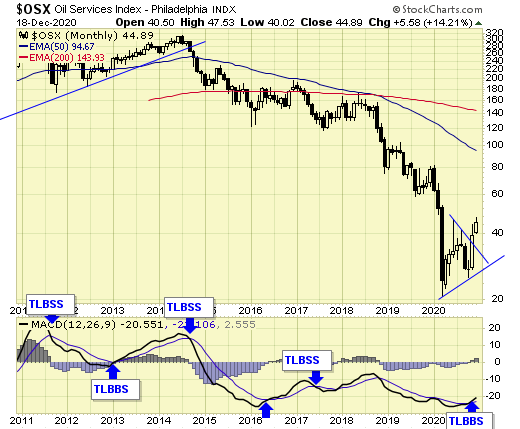

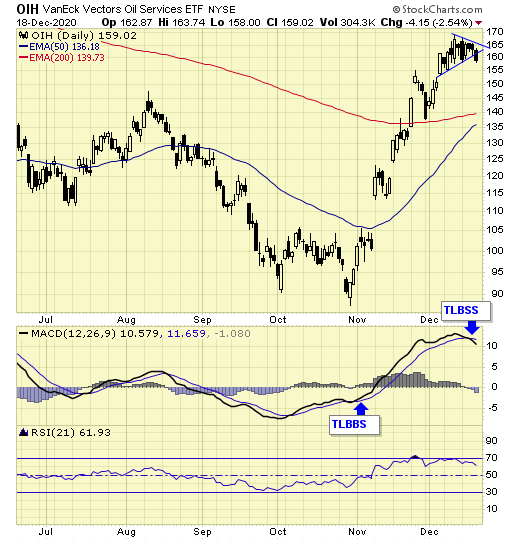

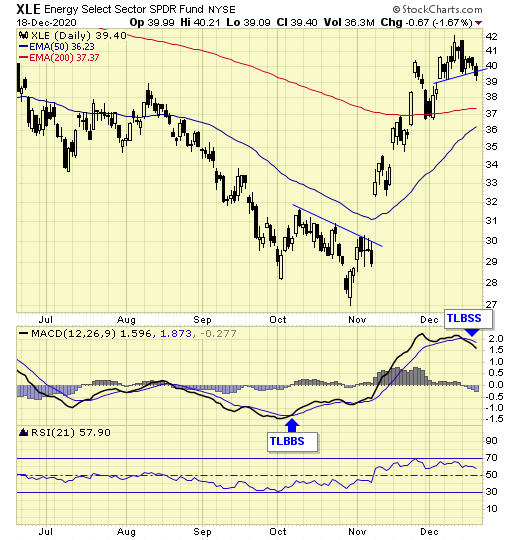

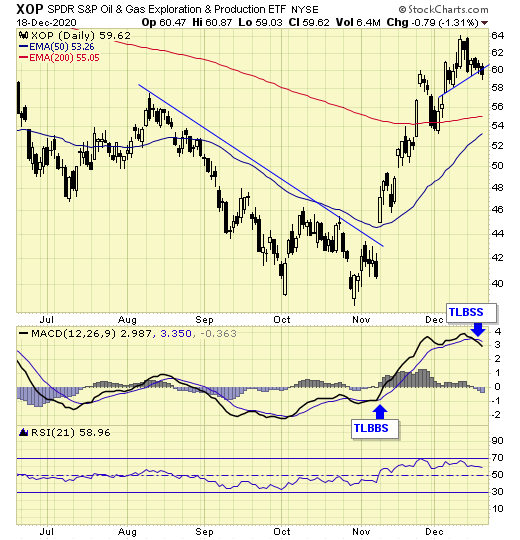

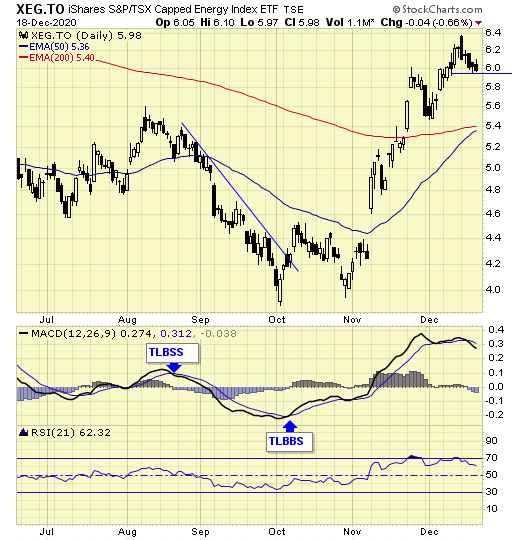

Energy UpdateBy Jack Chan at www.simplyprofits.org December 22nd, 2020 Signals and set ups Investors During a long term buy signal, investors can accumulate positions by cost averaging at cycle bottoms, ideally when prices are at or near the daily 200ema. During a long term sell signal, investors should be hedged or in cash. Traders Simply buy and sell upon buy/sell signals on the daily charts, or cost average in at cycle bottoms when prices are at or near the daily 200ema; and cost average out at cycle tops when prices are above the daily 50ema. Allocations Will be conservative when volatility is high, and aggressive when volatility is low. Current signals  Long term - on new BUY signal Short term - on mixed signals  OIH - TLBSS. Long from 103.50, no stop. 10% allocation. Closed out this week with a gain of +57%. We shall now wait for a new TLBBS.  XLE - TLBSS Long from 30.44, no stop. 10% allocation. Holding as a core position.  XOP - TLBSS. Long from 44.62, no stop. 10% allocation. Closed out this week with a gain of +36%. We shall now wait for a new TLBB  XEG.TO - TLBBS Long from 4.40, no stop. Allocation 10%. Holding as a core position Summary Long term (monthly chart) - on new BUY signal. Short term (daily chart) - on mixed signals. Cycle turned down this week. We took nice profits on OIH and XOP, and holding XLE and XEG.to as core positions for the long term. We shall now wait for a new TLBBS. End of update December 22nd, 2020 |

| Home :: Archives :: Contact |

MONDAY EDITION February 2nd, 2026 © 2026 321energy.com |

|